FOR IMMEDIATE RELEASE

U.S. and Global – 3PL Financial Results – 2006

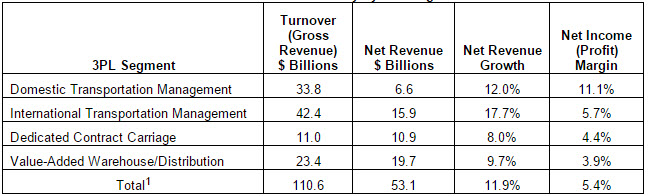

STOUGHTON, WI, April 9, 2007 – Third-party logistics gross revenues for the U.S. broke $110 billion for the first time in 2006. 3PL gross revenues hit $113.6 billion, a 9.5% increase. Net revenues were $53.1 billion. EBIT and net income margins in relation to net revenue were 8.6% and 5.4% respectively. Margins for the year were down slightly due to the fourth quarter economic slowdown.

As part of its just released report, Armstrong & Associates estimates the global third-party logistics market at $391 billion. European 3PL revenues are estimated at $139 billion.

For the U.S. market, International Transportation Management (ITM), which includes major components of freight forwarding and global supply chain management, had net revenue increases of 17.7%. Kuehne + Nagel, Expeditors, DHL Global and APL all had net income margins of 10% or greater compared to net revenue. ITM growth is primarily a reflection of continued economic expansion in China and the Asia Pacific markets.

Domestic Transportation Management (DTM), including freight brokerage, posted a 12% gain in net revenues (gross margin). Gross revenues (turnover) were $33.8 billion. BAX, BNSF, C.H. Robinson, Meridian IQ and NFI grew by more than 20%. Hub, Penske, Ryder and Werner grew by 10% or more. After-tax Net margin for DTM was 11.1%

DTM net revenue growth slipped from 18% in 2005 and net income margin dropped by 1%. We attribute these changes to the U.S. economic slowdown; they are temporary downturns and have no significant long term importance for key players in DTM. Despite the slowdown, C.H. Robinson still ended the year with net revenues of $1.1 billion and a net income margin of 24.7%. BNSF Logistics, Hub, NFI and Werner all had double digit net income margins.

Table 1. Revenues and Profitability by 3PL Segment – 2006

1 Total turnover (gross revenue) for the 3PL industry in the U.S. is estimated at $113.6 billion; $3 billion is included for the contract logistics software segment.

The complete report for 2006 can be obtained online at: https://www.3plogistics.com/shopsite/index.html. Armstrong & Associates’ Extended Information Service subscribers will receive the report next week.

The report can be purchased over the phone or online at: https://www.3plogistics.com/shopsite/index.html.

About Armstrong & Associates: Armstrong & Associates, Inc. is a supply chain management consulting firm specializing in market research, mergers and acquisitions and outsourcing. Armstrong & Associates publishes Who’s Who In Logistics? Armstrong’s Guide to Global Supply Chain Management. Recent research papers include An Overview of Warehousing in North America – 2007 Market Size, Major 3PLs, Benchmarking Prices and Practices and Brand Recognition, RFP Activity and Expected Profit Margins for 3PLs – 2007. In addition, Armstrong & Associates maintains databases of warehousemen, freight forwarders and third-party logistics and distributing companies.

For more information, contact: (800) 525-3915 or e-mail armstrong@3PLogistics.com.

Armstrong & Associates, Inc.

100 Business Park Circle

Suite 202

Stoughton, WI 53589

Phone: (608) 873-8929 Fax: (608) 873-5509

Website: www.3PLogistics.com