Redwood Logistics – Finding Ways to Drive Performance

Chicago, Illinois USA Site Visit

June 20, 2019

Redwood Personnel

Todd Berger, President and COO

Mark Yeager, CEO

Eric Rempel, CIO

John Centers, EVP of Sales

Michael Johnson, EVP of Strategy

Jim Liakos, CFO

Rising to the Top

Established in 2001 as Transportation Solutions Group, TSG’s founders saw an unmet need in the small to middle market of shippers for third-party logistics (3PL) domestic transportation management (DTM) services with advanced IT systems to make freight arrangement more efficient. TSG developed a proprietary transportation management system (TMS) for this purpose and grew at a steady pace.

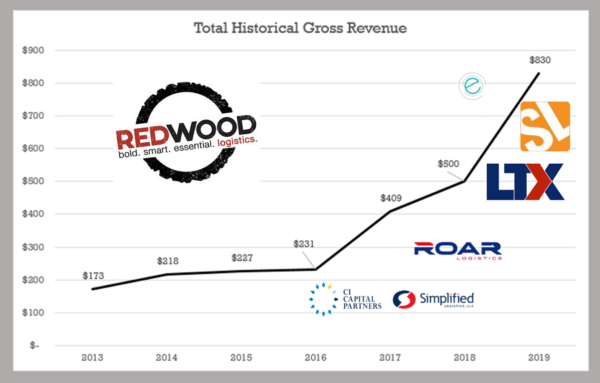

By 2013, TSG reached $173 million in gross revenue with the acquisition of Defined Logistics and The Treppel Group, and expanded its service portfolio to include freight forwarding, intermodal and warehousing services. At this point, TSG was mainly a dry van truckload freight broker.

In 2015, it rebranded as Redwood Logistics. The company entered a period of intense growth, which was then accelerated when it was acquired by CI Capital Partners and combined with Simplified Logistics in 2017.

From 2013 to 2018, Redwood grew at a compound annual growth rate (CAGR) of 24%. Over the past three years, its CAGR more than doubled to 53% from a growth strategy based on technology development for competitive differentiation, effective decision support to make optimal freight arrangement choices, and acquisitions for service portfolio and geographic expansion.

With the acquisition of Strive Logistics, Redwood Logistics became a Top-15 broker on a net revenue basis, with $110 million in net revenue and over $830 million in gross revenue.

The Strive acquisition provided Redwood with a new optimization tool, LoadRunner, a digital freight matching technology which Strive developed to automate carrier selection, making booking freight faster and more cost effective. LoadRunner amplifies Redwood’s strong foundation. Its freight matching algorithms represent industry-leading decision-support technology for brokerage.

Strong Results for Redwood Logistics & the U.S. DTM 3PL Segment

Redwood Logistics and its peers in the DTM 3PL segment benefited from heavy port-to-warehouse and warehouse-to-warehouse moves, the strong domestic economy, rising carrier rates, increased fuel surcharge revenue and continued outsourcing among shippers.

Armstrong & Associates estimates the 2018 U.S. 3PL non-asset-based domestic transportation management segment (DTM), which primarily consists of freight brokerage services, led all 3PL segments with overall gross revenue increasing an impressive 20.7%. DTM segment net revenue increased 23.2% to $13.4 billion.

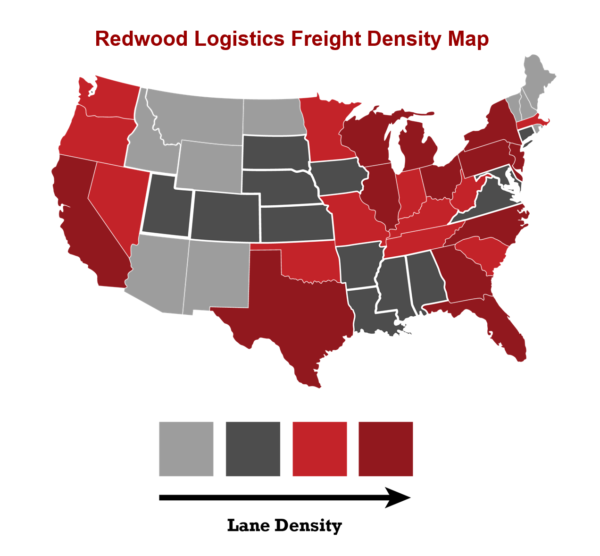

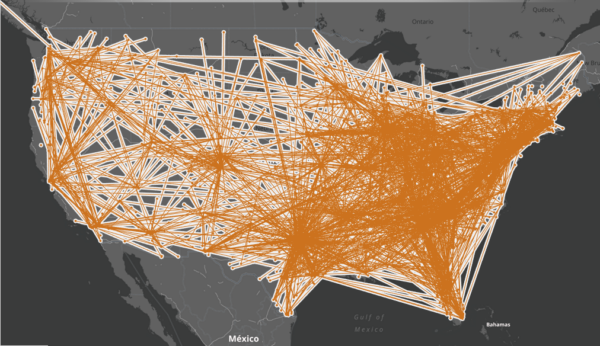

Redwood Logistics’ growth strategy and strong results in the freight brokerage market propelled the company to achieve critical mass in freight brokerage with freight under management for the combined companies exceeding $1 billion. The implications of reaching this milestone are significant for Redwood in terms of garnering advantageous rates, commitment from carriers for availability and the ability to offer dedicated carrier capacity to customers.

Acquisitions Expand Multimodal Services & Market Presence

Redwood’s growth strategy seeks to create enterprise value and strengthen service offerings by focusing on acquisitions that. . .

- Add scale to core truckload and transportation management service offerings;

- Extend its geographic reach and expand the scope of services; and

- Enhance technological capabilities to lower execution costs and aid decision-making.

In 2017, CI Capital Partners acquired Ohio-based less-than-truckload (LTL) service provider Simplified Logistics. In 2018, it merged Simplified with Redwood Logistics. Simplified Logistics, which added $120 million to top-line revenue and, more importantly, access to a developed LTL carrier base and rate tariffs. In addition to LTL brokerage, Simplified Logistics provides logistics consulting, transportation management and freight audit and payment services.

Last year, Redwood Logistics acquired the Phoenix-based freight management services division of ROAR Logistics. ROAR was founded as an intermodal marketing company (IMC) with a freight brokerage division that accounted for 50% of estimated gross revenue of $185 million in 2018 with a significant portion of refrigerated freight. It established Redwood’s presence in the Southwest.

Redwood Logistics launched into 2019 in good stride with recently announced acquisitions of LTX Solutions and Strive Logistics, and most recently, Eminent Global Logistics.

In January, Redwood announced the acquisition of Atlanta-based LTX Solutions, which provides LTL freight management. The acquisition enhanced Redwood’s capabilities in LTL brokerage and served its geographic expansion plan by providing an operational presence in the Southeast. LTX’s customers benefit from access to Redwood’s broader suite of services, including multimodal brokerage, transportation management, and technology implementation services.

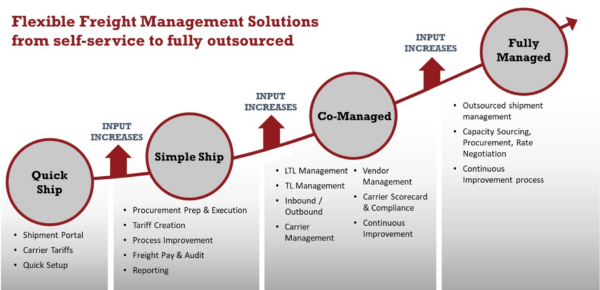

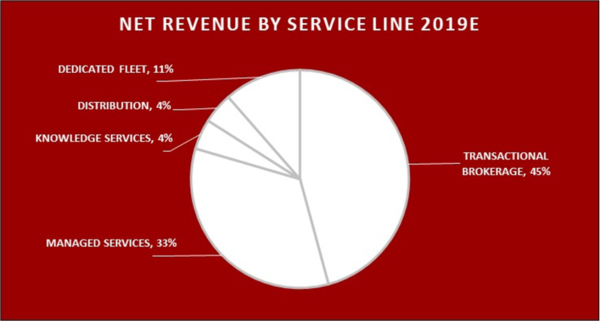

From its early days to now, Redwood’s service portfolio continues to shift from a primarily arm’s-length transactional brokerage to a much more diversified 3PL with significant net revenue generated by Managed Logistics Services, which now comprises 33% of net revenue. Redwood’s flexible service model aligns with specific shipper needs from co-managed to fully outsourced transportation management, enhanced by Knowledge Services.

Redwood’s flexible freight management model means that it can offer true end-to-end services that touch every part of a shipper’s supply chain. Redwood combines leading LTL and multimodal shipment management, a dedicated fleet, over one million square feet of warehouse space, proprietary technologies and integration expertise to create a mix of customizable solutions. Redwood firmly strays away from one-size-fits-all solutions and weaves in multiple service lines in most of its customer engagements.

Freight Exchange or F/X for short, Redwood’s Dedicated Fleet, operates as a dedicated contract carriage (DCC). Its operations remain a significant asset, accounting for 11% of net revenue, which is intended to serve specific closed-loop supply chain networks.

In March, Redwood Logistics announced the acquisition of Strive Logistics. Strive started in 1995 as a delivery and warehousing company for greater Chicago. For 2017, it reported $33 million in net revenue on $195 million in gross revenue with 240 employees and major offices in Chicago and Austin. Similarities in company culture are expected to make the integration of Chicago-based operations seamless. The addition of the Austin, TX location expands Redwood’s presence in the South in a dynamic urban culture that fits well with Redwood’s resourcing needs.

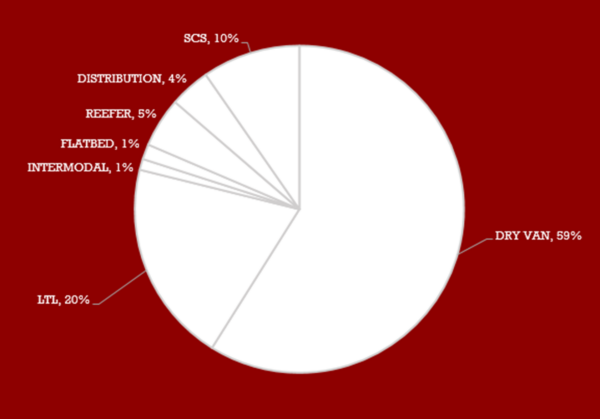

The combined companies control over $1 billion in freight. On a net basis, Redwood Logistics’ revenue breakout demonstrates the impact of key acquisitions with strong LTL capabilities, namely Simplified Logistics, LTX Solutions and Strive Logistics by expanding LTL to 20%, shifting dry van truckload to 59%.

Redwood offers Distribution services from locations in Chicago, El Paso and Atlanta. These warehouses are multi-client with primary customers and demonstrate Redwood’s efforts to provide holistic supply chain solutions to support transportation needs. Redwood uses HighJump WMS (warehouse management system) to provide consolidation and case pick services to shippers.

Knowledge Services Advantage: Integrating Ariens Company’s Distribution Network

Redwood Logistics adopted MercuryGate TMS as its primary transportation planning and execution system and recently added capabilities for Oracle OTM implementation with the acquisition of Eminent Global Logistics. Redwood developed information technology around both TMS’ for client integration, decision support and shipment visibility.

The company developed RedwoodConnect as an API (application programming interface) platform to enable integration with shipper host systems for shipment orders and reporting transactions. The customer-facing application is RedwoodInsight, which provides shippers with web-enabled real-time reporting and access to shipment information for analysis and performance reporting.

Redwood’s Knowledge Services is a separate business service that offers shippers’ access to MercuryGate TMS and Oracle OTM on a software as a service (SaaS) basis, allowing customers to manage transportation planning and execution on their own with robust tools, such as DockScheduler, which is designed to enable load planning and shipment scheduling.

Ariens Company, a manufacturer of snow throwers and lawn mowers, engaged Redwood’s Knowledge Services to resolve challenges created by Ariens’ seasonal order variability, unanticipated regional demand changes due to weather events, need for equipment build-up in advance of peak demand, and coordination of inbound materials planning for Lean manufacturing. One key metric was a service level requiring the shipment of finished goods within three days of order receipt. Warehousing was managed by a separate 3PL. Ariens was barely reaching 50% at the start. Redwood identified the need for integrated planning and execution between the host order management system (ERP), Redwood’s TMS solution and the warehousing 3PL’s WMS.

Process integration was achieved via RedwoodConnect which served as the integration platform and data repository for critical decision-making data and performance measurement, such as order to delivery cycle time and cost per delivered pound. These metrics revealed the need for Ariens to adjust its distribution network. Redwood performed supply chain network modeling to find the optimal configuration in a hub-and-spoke design with two central distribution points with smaller, regional fulfillment centers. These changes increased fulfillment cycle by 30 points and nearly halved freight spend as a percent of sales.

Expanding IT Advantage with Strive’s LoadRunner Platform

The acquisition of Strive Logistics will enhance Redwood’s IT capabilities. As a “tech-enabled 3PL,” Strive developed a proprietary TMS, called LoadRunner, with customer self-service capabilities that incorporate artificial intelligence and process automation in freight arrangement, such as to make better carrier selection decisions based on collected market rates and carrier qualifications.

LoadRunner’s carrier selection algorithms make probabilistic bets on which carriers can offer customers the best value and are most likely to accept the load. LoadRunner’s algorithms are dynamic in that as new information enters the system, the outcomes and suggested carriers change in real time. Prior to LoadRunner, 90% of the capacity was sourced from public load boards. In a matter of months, load board sourcing was reduced to 10%. LoadRunner, as well as the company’s technologically savvy pricing and digital freight matching tools, played a big role in Redwood’s decision to acquire Strive.

Redwood effectively transitioned from a simple TMS reseller to a full-service integrator, software developer, and technology consultant by focusing and investing in operating on the forefront of logistics innovation. The industry has changed more in the last five years than it did in the previous 25 and will continue to do so at an even faster clip in the future. Through technology investments, like RedwoodConnect, the company can integrate Oracle OTM, LoadRunner and MercuryGate TMS to offer robust decision-support and execution capabilities.

Growth Trajectory

Redwood is pursuing a comprehensive growth strategy with key tenets including broadening of the 3PL services portfolio, geographic expansion into important freight markets, continuous investment in information technology as a competitive differentiator and complementary Knowledge Services to solve customers’ logistical challenges through analysis and IT systems integration support.

Sources: A&A Primary Research, http://www.redwoodlogistics.com/