CJ Rokin Logistics Leads with Innovation and Process Management to Drive Growth in China

Shanghai and Kunshan, China Site Visits

July 30, 2018

By

Evan Armstrong

Key Personnel:

Park Keun Tae, President/CEO, CJ Logistics

Shon Kwan Soo, CEO, CJ Logistics

Xiong Xing Ming, CEO, CJ Rokin Logistics

Jae Hyuck Auh, Managing Director for Greater China, CJ Logistics

Avril Gong, Assistant to Vice President, CJ Rokin Logistics

Shin Dong Hui, Vice President, CJ Logistics

Chong Young Kim, General Manager, Marketing Team, CJ Logistics

CJ Logistics Overview

With 2017 gross logistics revenue of $4.6 billion, South Korea-headquartered CJ Logistics ranks 21st of all 3PLs (third-party logistics providers) globally and is the 16th largest global warehousing 3PL with a total of 38 million square feet. (CJ Logistics’ total revenue for 2017 was $6.3 billion encompassing Contract Logistics, Parcel, Forwarding & International Express, Stevedoring & Transportation and Project Logistics.) CJ Logistics’ 3PL service offering includes Domestic and International Transportation Management, Value-Added Warehousing and Distribution (VAWD), and Port Services. CJ Logistics manages freight forwarding volumes of 310,850 ocean TEUs (twenty-foot equivalent units), 57,014 air freight metric tons, and a network of 394 warehouses totaling 38 million square feet. Its regional network revenue breakdown is 41% from Southeast Asia, 36% from China, 13% from North America, and 10% from other countries. Food and Consumer Goods customers account for 40% of its revenue, followed by Industrials at 16%, Chemicals and Fashion at 13% each, then Auto/Parts and High-Tech at 9% each. CJ Logistics’ key 3PL accounts include: CJ CheilJedang, Hankook Tire, Lazada, POSCO, and Starbucks. Its operations tend to be well run with an emphasis on innovation, “Lean” management principles, and quality control.

Since 2013, CJ Logistics has accelerated its global expansion strategy in an effort to become a Top 5 Global 3PL through aggressive mergers and acquisitions in China (CJ Smart Cargo, CJ Rokin Logistics, CJ Speedex Logistics), Malaysia (CJ Century Logistics), India (CJ Darcl Logistics) the Middle East (CJ ICM Logistics) and Vietnam (CJ Gemadept Logistics, CJ Gemadept Shipping). CJ Logistics has 257 global logistics networks in 33 countries. In addition, CJ Logistics recently acquired a 90% stake in Des Plaines (Chicago), IL USA headquartered DSC Logistics for $216 million. The DSC acquisition will add $578 million to CJ Logistics’ North American gross revenues and 44 warehouses totaling 23 million square feet. Strategically DSC is a good fit with CJ Logistics since 86% of its revenues come from Food and Consumer Goods industry customers.

CJ Rokin Logistics China Overview

In 2015 CJ Logistics acquired Shanghai, China-headquartered 3PL Rokin Logistics for $382 million. CJ Rokin Logistics’ roots go back to 1985 when its founding brothers Yuqing and Yurong Zhang needed a way to transport produce from rural farms in their home town in Shandong province to Shanghai. They entered the transportation business to meet these customers’ needs. Combining parts of each other’s names they established Rokin Logistic Co., LTD in 1997. In 2004 they began to develop cold chain logistics services to support food and grocery customers. Private equity investor Capital Today (made famous from its early investment in JD.com) invested 200 million RMB in Rokin in 2007 allowing it to expand into chemical logistics services in 2008. After substantial growth, Rokin established its headquarters in Shanghai and segmented its company into three distinct divisions: cold chain logistics, general cargo logistics, and chemical logistics. 2013 saw many technological upgrades for Rokin and in 2015, it was acquired by CJ Logistics.

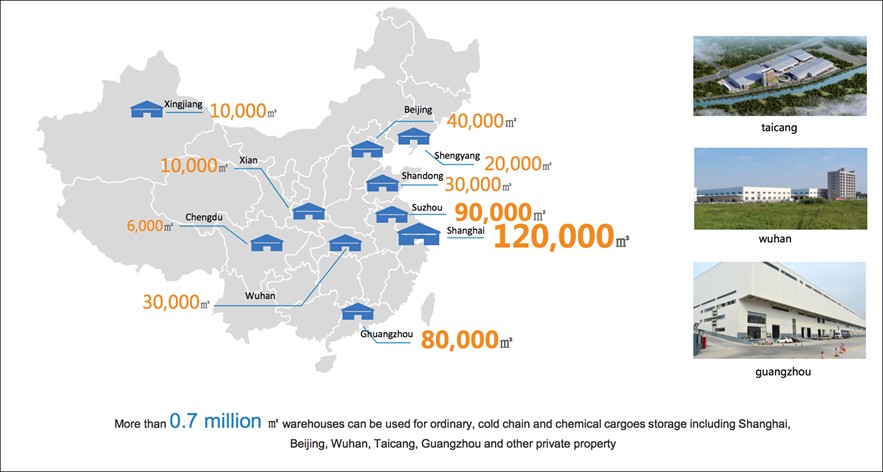

Today, CJ Rokin Logistics is growing 40% a year and is on track to have 2018 revenue of $500 million. CJ Rokin Logistics currently has a staff of 5,000 supporting its value-added warehousing and distribution, and domestic transportation management operations. It has a warehousing footprint of over 7.5 million square feet with operations in Beijing, Chengdu, Guangzhou, Shandong, Shanghai, Shengyang, Suzhou, Wuhan, Xian, and Xingjiang.

CJ Rokin Logistics' China Warehousing Network

CJ Rokin Logistics runs a less-than-truckload (LTL) shipment consolidation and distribution network of 120 terminals (branches) and 27 major crossdocking hubs (logistic bases) serving 1,500 cities. Its trucking assets include 850 dry vans, 390 refrigerated units, and 260 chemical hauling units. In addition, it has contracted capacity totaling over 60,000 trucks.

CJ Rokin Logistics' LTL Consolidation and Distribution Network

In addition to its core 3PL service offering, CJ Rokin Logistics provides third-party logistics customers with significant consulting and engineering expertise through its Shanghai SCM Consulting practice with a staff of 15, which work within Rokin’s TES Innovation Center operations.

CJ Rokin Logistics’ key customers in China include: BASF, Bayer, Dow, Fonterra, Huntsman, L’Oréal, Mars, Mary Kay, Mead Johnson, Perfetti, Staples, and Starbucks. Rokin’s top 30 customers generate approximately 70% of its total revenue.

TES Innovation Center China Operations

CJ Rokin Logistics spends a significant amount on innovation to drive better supply chain management solutions for customers. TES, stands for Technology, Engineering, System & Solution to develop solutions combining state-of-the-art technology, optimal processes, and the best IT services. We had the opportunity to visit TES Innovation Center China; the only one outside of South Korea.

At the TES Innovation Center engineers and consultants research ways to improve existing customer operations, design new operations, and explore new technologies which can be used in customer operations.

We saw engineers using 3D virtual reality to help redesign a warehouse conveyer system for a large customer by running multiple design scenarios using current and projected order volumes.

CJ Rokin Logistics has developed multiple warehouse picking methods for customer operations. One proprietary system is a wheeled picking cart with multiple bins designed to pick smaller quantity orders with multiple SKUs (stock keeping units). Dubbed “W-Navigator,” it interfaces to a warehouse management system (WMS) via smart devices providing pickers with optimal pick route assignment, increasing warehouse productivity.

The innovation center is also working with AGVs (automated guided vehicles) to bring racks to stations for picking and packing. When interfacing with the WMS, AGVs can automatically plan routes based upon orders and sequence multiple warehouse picking tasks in the optimal order. It is an example of using automation to bring warehouse inventory to workers for a more efficient pick/pack operation.

CJ Rokin Logistics has also deployed AS/RS (automated storage and retrieval systems) “putaway and picking cranes” for many customers. AS/RSs run in a “lights out” environment with handling units being putaway into very narrow rack positions and picking being done by automated cranes. The system is capable of handling the putaway and picking of pallets, totes, trays, bins and cartons in high-volume environments, while taking up minimal space.

The innovation center also incorporates an automated inspection area. It uses a robot to build cartons. Items can be picked utilizing the technologies mentioned above and packed into the cartons. The cartons then travel to an integrated inspection station where sensor and optical technology is utilized to scan barcodes, measure and weigh the product and its volume, and check for order accuracy prior to shipping.

CJ Rokin Logistics is using much of its innovation center technology in fairly automated operations for Staples and Starbucks.

In addition to the technologies mentioned above, CJ Rokin Logistics is experimenting with multiple sensors, and robots and drones for inventory cycle counting and reading RFID (radio frequency identification) tags, to increase overall warehouse inventory visibility.

Kunshan Multi-client VAWD Operations

After seeing the TES Innovation Center China, we headed to Kunshan, a city in southeastern Jiangsu province bordering Shanghai to the east on the way to Suzhou. In Kunshan, CJ Rokin Logistics runs a multi-client warehouse campus totaling 808,000 square feet, with a staff of 628.

The operation utilizes five different types of racking based upon customer requirements: pushback, standard, shuttle, cantilevered, and light-duty racking. We had the opportunity to review three of its 18 warehouse customer operations, including its most automated operation for Staples. Each operation is managed using a Six Sigma continuous improvement approach. Value-added services being performed include: labeling, packaging and repacking, pick/pack, product quality testing, and returns processing.

The first operation we reviewed was a 68,000 square foot warehouse for Wyeth Pharmaceuticals baby formula and promotional materials. It has a staff of eight managing 820 SKUs (stock keeping units) of on-hand inventory. Order volumes are approximately 4,000 per month in the primarily case and pallet picking operation. Key performance indicators include metrics for inventory accuracy, productivity, damages, and sanitation.

The next operation we visited had a staff of 14 people working in two shifts for household appliance maker Termomix (Vorwerk). The operation has approximately 850 SKUs of product stored in five-high racking in 65,000 square feet of warehouse space. Average outbound order volume runs around 400 orders per day in the piece/case pick operation.

To ensure high product quality, CJ Rokin Logistics performs product inspections for Vorwerk based upon SKUs. At the time of our visit, an inspection was being performed on baby food makers. In addition to product inspections, CJ Rokin Logistics is processing returns for Vorwerk as another value-added service.

The last operation we reviewed was a domestic warehousing and distribution operation for Staples. The operation consists of two 27,000 square foot storage areas and a 65,000 square foot automated pick, pack, and replenishment area. With 12,000 SKUs of product in a high-volume each-picking environment with small order quantities, CJ Rokin Logistics deployed its proprietary Multi-Purpose System (MPS) for the Staples operation.

The MPS is designed to improve on pick-to-light (PTL) systems, which use LED readouts to direct pickers to locations of goods, and quantities required based on data provided by a WMS. MPS eliminates all paperwork, and stock movements are controlled electronically. Information is transmitted to the warehouse, and the picker is directly notified of the work to be done at each of the shelves, and where the product is to be stored. An MPS indicator (MPI) is an electronic device that can be installed anywhere within a warehouse or factory, to display instructions to employees. MPS indicators (MPIs) are installed on shelves at each picking station. The devices can illuminate different colors to signal different instructions, show pick quantities, and can flash an arrow indicating whether a picker needs to pick from the shelf compartment above or below the display. While traditional PTL systems also guide workers to the appropriate location to find stock, CJ Rokin Logistics uses passive RFID tags on its totes to completely automate the process eliminating the need to manually scan bar codes on containers used to carry ordered items, thus increasing productivity.

The basic process is as follows. Product is moved from storage shelves to replenish shelves in the high-volume MPS area. Within the MPS area pickers work in zones. As a tote for an order passes a zone, the MPI might light up specifying the number of products needed for the order. The MPI also changes color to match the color of the tote and indicates if the product comes from the upper or lower shelf location. After picking, the tote is automatically conveyed to a pack station where it is scanned, order quantities are checked, shipping labels are printed, and the order is packed out.

Individual cartons are then staged by destination city. From the warehouse, CJ Rokin Logistics can manage the final delivery to one of Staples Regional Distribution Centers through one of its LTL consolidation crossdocking operations, or as direct truckloads delivered to stores.

Baoshan LTL Hub Consolidation Center

Baoshan is a northeastern area in Shanghai. CJ Rokin Logistics runs a 926,000 square foot LTL hub and local delivery crossdock operation in Baoshan consisting of four crossdocks, run by a staff of 1,220, with a complement of 240 local pickup and delivery trucks. LTL shipments from the Shanghai metropolitan area are crossdocked with most being loaded into full truckload linehaul units destined for other crossdock hubs, or final delivery terminals. The operation dispatches approximately 700 linehaul units per day. Many of CJ Rokin Logistics’ warehousing customers also utilize its LTL consolidation service as part of an integrated service offering.

Warehouse A is a 76 dock door and 38 lifting platform operation. It consolidates LTL shipments from Shanghai into truckloads destined to Beijing, Guangzhou, Shenzhen, Wuhan, Hangzhou, Jiaxing, Ningbo, Qingdao, and Yantai.

Warehouse B has 60 dock doors and 18 lifting platforms. It is divided into two separate crossdocking operations. The first, consolidates LTL shipments from Shanghai into truckloads destined to Shandong, Shanxi, Hebei, and Xinjian provinces, and to Inner Mongolia. The second crossdocking operation, consolidates LTL shipments from Shanghai in to truckloads destined to Fujian, Qinghai, Yunnan, Guizhou, Tibet, Henan, Heilongjiang, Jilin, and Guangdong.

Warehouse C focuses on providing value-added services for two cosmetic manufacturers. Inbound materials are sorted and packaged into new cartons. They are then shrink wrapped to avoid potential water damage.

Shanghai area shipments are crossdocked to appropriate local delivery trucks in warehouse D. It has 64 dock doors and 32 lifting platforms.

CJ Rokin Logistics Operations Summary

With a focus on innovation and Six Sigma management skills, CJ Rokin Logistics is growing at a rate of 40% a year in a very competitive domestic China 3PL market. Its ability to provide state-of-art value-added warehousing and transportation management operations is helping CJ Rokin Logistics secure business from large multinationals, as well as domestic Chinese customers. With its focus on innovative solutions and quality operations, we anticipate CJ Rokin Logistics will continue its growth trajectory as a leading domestic China 3PL.

Sources: A&A Primary Research, http://www.cjlogistics.com/