CJ korea express “Revs Up” its Growth Strategy

South Korea Site Visits

July 28, 2015

By

Evan Armstrong

Key Personnel:

Pious Jung, Management Specialist, CJ Corporation

Yong Seok Park, Senior Executive Vice President – Global Business Unit, CJ korea express

Jae H. Auh, Senior Vice President – Logistics Research Institute, CJ korea express

Chol-Hoi Kim, General Manager – Investor Relations Team, CJ korea express

Jay Ahn, Director – Strategy Planning Division, CJ korea express

SangKon Yeo, Senior Manager – Global Strategy Support Team, CJ korea express

CJ korea express Overview

With 2014 gross logistics revenue of $3.7 billion (excluding its parcel business revenue of $1.2 billion), CJ korea express ranks 24th of all 3PLs (third-party logistics providers) globally and is a top 25 global freight forwarder. CJ korea express’ 3PL service offering includes Domestic and International Transportation Management, Value-Added Warehousing & Distribution (VAWD), and Port Services. Its global staff of 17,000 manages freight forwarding volumes of 394,940 ocean TEUs (twenty-foot equivalent units), 51,202 air freight metric tons, and a network of 390 warehouses in 21 countries totaling 18.3 million square feet. Of the $1.4 billion of 3PL gross revenue CJ korea express generates outside of Korea, 39% comes from Southeast Asia, 35% is from China, 14% comes from the U.S., and 12% is derived from other countries/regions. CJ korea express’ key 3PL accounts include: Costco, GM Korea, Hyundai, Levi’s, Nestlé and Starbucks. Operations tend to be well run with an emphasis on “Lean” management principles and quality control.

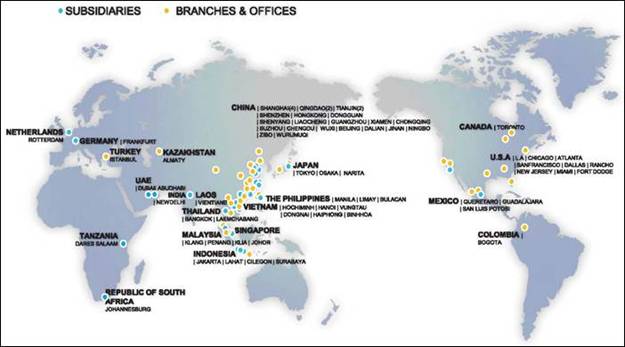

CJ korea express Global Operating Network

In addition to its 3PL operations, CJ korea express is the largest Korean parcel carrier. Its parcel operations give CJ korea express significant integrated capabilities domestically to support Omni-channel distribution for retailers and other customers. Its parcel unit generates $1.2 billion in revenue, has a delivery network of 215 hubs and terminals, and manages a fleet of over 16,000 trucks (owned and contracted).

Long-term, CJ korea express’ strategy is to grow its size and network scale to build a $25 billion global 3PL by 2020. To meet its growth objectives, CJ korea express is putting significant focus on acquisitions and prospects to derive half of its gross revenue from outside of Korea in 2020. In conjunction with acquisitions, CJ korea express is planning to grow organically within Korea and by developing new business with multinationals, retailers, and through ecommerce services in international markets.

CJ korea express plans to grow its domestic parcel market share from 38% to 50% and expand its domestic VAWD and port operations footprint. It is also looking to gain additional revenue in new markets via additions to its service portfolio.

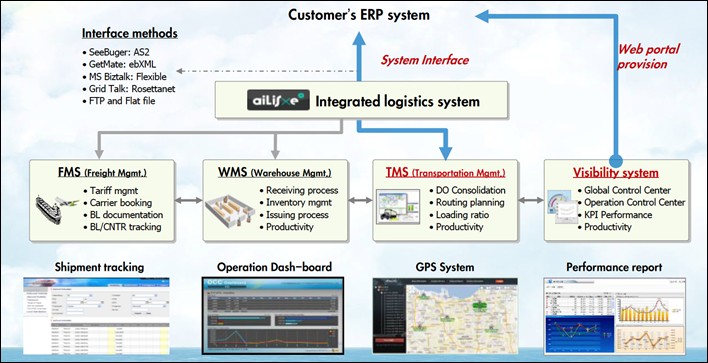

To support its operations, CJ korea express has built a proprietary suite of supply chain management systems dubbed “Ailis-Xe” (Advanced Integrated Logistics System–extension of ecommerce). The suite includes components for customer relationship management, order management, warehouse management, domestic and international transportation management, and overall visibility. Business intelligence reporting via a customer portal “storefront” and a contracted logistics provider portal are integrated with the core applications.

CJ korea express Proprietary “Ailis-Xe” IT Systems Backbone

CJ korea express has developed significant supply chain management consulting capabilities which often leverage its IT systems. Its consulting staff works with new and existing customers to improve operational efficiencies and drive out waste. Typical consulting projects include: transportation network design/redesign, distribution network design/redesign and DC layout, transportation routing, warehouse labor productivity, and warehouse throughput optimizations.

During our visit to Seoul, we had the opportunity to review multiple CJ korea express operations. The highlights from these visits are detailed below.

Dukpyung Center Operations

Southeast of Seoul in Dukpyung, CJ korea express runs a 710,400 square foot, two-building VAWD operation serving 32 consumer goods and retail customers including: eMart, Nivea, Heinz, and Starbucks. The operation runs 24 hours per day/6 days per week and is staffed by four supervisors and 101 warehouse workers per shift. The warehousing operations run on CJ korea express’ proprietary systems integrated to RF (radio frequency) scanners to manage tasks.

At the time of our visit, there were 10,759 SKUs (stock keeping units) of product in on-hand inventory. Most product is received into the warehouse in pallet quantities and shipped out as pallets or cartons.

Approximately 2,500 orders are fulfilled each day. Outbound shipping to regional distribution centers and direct to stores averages 93,000 cartons per day, with a peak volume of 170,000 cartons per day.

Approximately 2,500 orders are fulfilled each day. Outbound shipping to regional distribution centers and direct to stores averages 93,000 cartons per day, with a peak volume of 170,000 cartons per day.

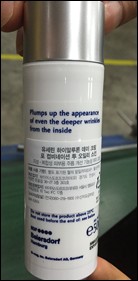

Building A houses inventory for global customers and has two floors. The 140,000 square foot first floor operation has a staff of 12 performing value-added services and fulfilling orders for four customers. Part of the operation was fulfilling orders for fashion accessories company Folli Follie. In addition, returns were being processed against RMAs (return material authorizations). Nivea lotions were being labeled for the local Korean market and repacked.

For the operation, inventory accuracy was 99.99% and real-time inventory match was 99.8% at the time of our visit.

In addition to the VAWD operations at Dukpyung, CJ korea express manages a research and development center for material handling equipment. It develops and performs feasibility studies for internally developed loading and unloading equipment, tests RFID sortation systems, develops pick to light solutions, and researches robotic technology.

Hobub Apparel VAWD Operations

A short drive from the Dukpyung operation, CJ korea express runs its Hobub fashion industry focused VAWD operation. Hobub totals just over 28,700 square meters and is split into two equal sized warehouses (14,000 SQM each). The first warehouse is dedicated to sports brand company Puma.

The Puma VAWD operation runs from 9 AM to 10 PM five days per week and fulfills outbound orders to 133 stores in South Korea. It is the single distribution operation for Puma in South Korea and manages an inventory of over 5,000 SKUs of product with a warehouse staff of 25 to 70 depending upon seasonal demand.

Most products are received in ocean containers from overseas manufacturers. Upon receipt, products are weighed and counted to check product quantities against purchase orders. Next, products are segregated by SKU onto individual pallets. Some random quality control product sampling is also performed during receipt. After receiving, Puma products are putaway into racked storage locations.

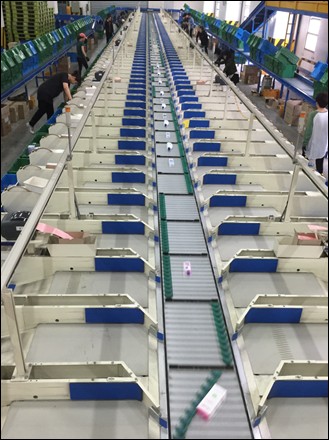

Using CJ korea express’ proprietary WMS to drive picking, individual items are moved to steel rollers and injected into a sortation line driven by CJ korea express’ parcel sorting system. Products are sorted to individual lanes designated for each of the 133 stores. Approximately 20,000 pieces are sorted each day. At the bottom of each sortation lane is a carton. Once all of the items for an outbound order are in the carton, the system notifies warehouse staff and a final weight check is made by the WMS. The system prints a shipping label and Puma’s invoice, and the carton is sealed. Next it is staged for shipping. CJ korea express manages all of Puma’s outbound transportation.

Using CJ korea express’ proprietary WMS to drive picking, individual items are moved to steel rollers and injected into a sortation line driven by CJ korea express’ parcel sorting system. Products are sorted to individual lanes designated for each of the 133 stores. Approximately 20,000 pieces are sorted each day. At the bottom of each sortation lane is a carton. Once all of the items for an outbound order are in the carton, the system notifies warehouse staff and a final weight check is made by the WMS. The system prints a shipping label and Puma’s invoice, and the carton is sealed. Next it is staged for shipping. CJ korea express manages all of Puma’s outbound transportation.

Additional value-added services being performed include product tagging and labeling, price tagging, and bagging. The Puma operation’s KPIs (key performance indicators) include inventory accuracy, on-time delivery, and outbound order fulfillment rates.

The second Hobub warehouse houses operations for Levi’s, MPG, Mizuno, and Shoemarker. It also contains 15 temperature and humidity control units for special product handling.

GM – Korea, Incheon KD and DKD Operations

CJ korea express is a lead logistics provider for General Motors – Korea. It manages inbound milkruns from vendors, kitting, subassembly, and line sequencing into GM Korea’s two manufacturing plants. After manufacturing, CJ korea express works with GM in managing car and car components exports; in GM terminology, these processes are referred to as DKD (Disassembly Knock Down) and KD (Knock Down).

At a warehousing operation near the Incheon port west of Seoul, CJ korea express works in conjunction with GM Korea personnel in supporting its KD process. The KD process focuses on exporting kits of parts for unassembled car components which include instructions for final assembly.

At a warehousing operation near the Incheon port west of Seoul, CJ korea express works in conjunction with GM Korea personnel in supporting its KD process. The KD process focuses on exporting kits of parts for unassembled car components which include instructions for final assembly.

Inbound parts are received into the 7,000 SQM (75,347 square feet) Incheon KD Center (warehouse). Upon receipt, parts are inspected and entered into GM’s system. Based upon component demand, the parts are merged into kits which can be used after export at GM and customer operations to assemble the car components. CJ korea express is responsible for export packaging, container loading, and the freight forwarding of the KD export shipments. Approximately 43 export ocean containers of KD components are managed by CJ korea express daily.

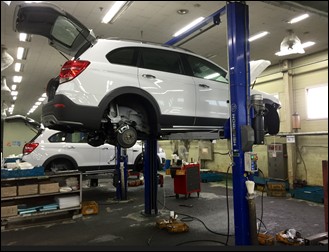

In a 30,000 SQF facility, also near the Incheon port, CJ korea express runs GM Korea’s DKD operation. Approximately 4,000 fully manufactured vehicles for export are received at the facility per month where they are partially disassembled for ocean container shipping. First the engine, transmission, tires, and bumpers are removed from each vehicle. Associated parts are packed out in gaylord types of containers. Engines are packed into a special metal container and the semi-disassembled car is packed at a 45 degree angle on a metal rack which can fit in the ocean container. CJ korea express manages the export ocean freight forwarding.

Dedicated VAWD Operation in Gunpo KIFT¹ – Olive Young Warehouse

Dedicated VAWD Operation in Gunpo KIFT¹ – Olive Young Warehouse

Through its dedicated, multilevel value-added warehousing & distribution operation in Gunpo KIFT (Korea Integrated Freight Terminals), Olive Young (a Korean drug store chain) and other ecommerce retailers are managed by CJ korea express operating 24 hours/6 days per week with a staff that includes seven managers and 100 warehouse personnel.

Outbound shipments to 430 store locations are assembled on the operation’s first floor and product is stored and picked from warehousing operations located on floors 3, 5, and 9. Each floor has 5,000 square meters (53,820 square feet) of space and is linked by a conveyer system.

Approximately 8,000 SKUs of inventory are maintained on the warehousing floors. Floor 9 is where larger products and cartons are stored. Items are picked to cart, or by forklift from rack and shelf locations. Most of the larger items are conveyed to the first floor to be assembled for store delivery. Some smaller items and cartons are conveyed to floor 5 to be added to totes of other picked products.

Floor 5 replenishes smaller personal care and food product items from rack locations into 10 each-pick lanes. Each lane is utilized to pick items destined to 43 individual stores and is controlled by a pick to light system, which CJ korea express has internally developed and engineered, dubbed “MPS” (Multi-Purpose System). Workers pick to individual Olive Young store totes. The totes are then conveyed to floor 3 where beauty care products are sorted and added to the individual store totes.

Floor 3 uses a sortation system to sort small beauty care items to individual store totes. Eight induction lines from the warehouse floor are merged into one line for sortation.

On the first floor, all products are assembled onto staged individual store carts in preparation for shipping.

In addition to the outbound shipping on floor 1, there is a mezzanine which houses a returns operation for Olive Young. Approximately 60,000 returned pieces are processed by CJ korea express each month.

KPIs for the operation include: inventory accuracy, picking accuracy, returns processing time, on-time delivery, delivery accuracy, and damages.

CJ korea express Operations Summary

Leveraging skills developed in the South Korean and major global 3PL markets, CJ korea express has built a leading integrated global 3PL. Its service offering is extensive with significant capabilities in Domestic Transportation Management, International Transportation Management, and Value-Added Warehousing & Distribution.

As it eyes acquisitions, we anticipate it will expand its footprint further into the Americas and Europe while continuing to improve global business performance in China and Southeast Asia. Its expansion will provide customers with another well-suited option for outsourced supply chain management.

¹KIFT (Korea Integrated Freight Terminals) is engaged in the integrated freight terminal business in South Korea and offers warehousing and other logistics services.

Sources: A&A Primary Research, http://www.cjlogistics.com/