Schneider Automotive Logistics, Ford and General Motors – The Model Has a Lot More Than T

Schneider Logistics

Farmington Hills, Michigan USA

November 11, 2003

By

Richard Armstrong

Key Personnel:

Steve Kowalkoski, VP Automotive

Schneider Logistics, Inc. is a major automotive logistics 3PL. A large portion of its total revenue is derived from automotive logistics. The core of its business is long-term partnerships with Ford’s Customer Service Division (CSD) and General Motors Service Parts Operation (GMSPO).

Ford and GM are Schneider Logistics’ largest accounts. The relationships have been in place for nearly a decade. Schneider Logistics functions as a Lead Logistics Provider for both companies, but Ford’s new segmented inventory approach has created special opportunities. Schneider has been able to use its strong engineering and software capabilities to help Ford create a spare parts replenishment for dealers. Ford has cut its parts inventory costs by over 20% in the process.

Ford’s new segmented approach to inventory management for North America is a modernization for others to emulate. The idea was Ford’s – the strategic design, implementation and operation are Schneider’s. Here is how the system works.

First, Ford broke its inventory up into fast-moving, bulky and slow-moving parts. The fast-moving parts are about 85% of the total. Bulky and light weight body parts are about 10%. Slow-movers are only about 5%. Rather than store all parts at all DCs, Ford and Schneider set up a network of strategically located DCs to provide 1-2 day service to dealers on all parts. Fast-moving parts need to be delivered overnight. Body parts for disabled and damaged vehicles usually get 2 day service. Slow-moving parts, such as those for 10-year old cars, are 1-2 days service direct to dealers. For fast-moving parts, Ford set up 19 high-velocity distribution centers (HVCs). Located near every HVC is a Schneider Logistics cross-dock. These cross-docks are controlled by Schneider and subcontracted to other 3PLs. For its body and other light weight items, Ford set up 3 locations (HCCs). For its slow-moving parts, there is a National Parts Distribution Center (NPDC). There is one location for very heavy low-value parts (Memphis). Finally, there is a single Parts Replenishment Center (PRC) which has every stocked part a Ford dealer might need. The PRC ships to the 19 high-velocity centers (HVCs), and the three high-cube body parts centers (HCC). These 22 distribution centers feed the Schneider cross-docks. From Schneider’s cross-docks, standard delivery routes to dealers are run using dedicated contract carriers.

Dealers are supplied from the Memphis operation (LVLC) and the slow-moving parts center (NPD) by direct truck and air service.

Schneider engineered the static, dedicated delivery routes to dealers using its supply chain engineering tools. Schneider has made a substantial commitment (30+ people) to its research design and supply chain engineering operations for years. This intellectual capital operation also helped Ford design the network and key locations for all the distribution centers. The primary modeling and optimization tools used were AMPL Plus and CPLEX.

The dedicated contract carriers doing deliveries are controlled by Schneider Logistics. They mostly use Penske Logistics operations for delivery.

To perform its day-to-day operations, Schneider requires good IT systems. These systems are particularly important for managing the suppliers and packagers who feed parts into the system. The key piece is Schneider Logistics’ collaborative visibility web-enabled tool (SUMIT CVN).

CVN monitors releases from suppliers, tracks all transportation execution events and provides visibility throughout the supply chain. Ford, GM and Case New Holland are all major CVN users. CVN is a key overlay of Schneider’s IT coverage from planning, to rating, to optimization, then on to transportation management and reporting. Schneider Logistics’ IT capabilities and supply chain control continue to be among the best in the business.

Schneider has added a web-based bid process to SUMIT. This carrier visibility auction (CVA) is an interactive process that allows core carriers to commit capacity at agreed to prices for one year at a time. It is more user-friendly than its competitors because of its ability to allow carriers to bundle options and allows for special constraints for minority carriers, etc.

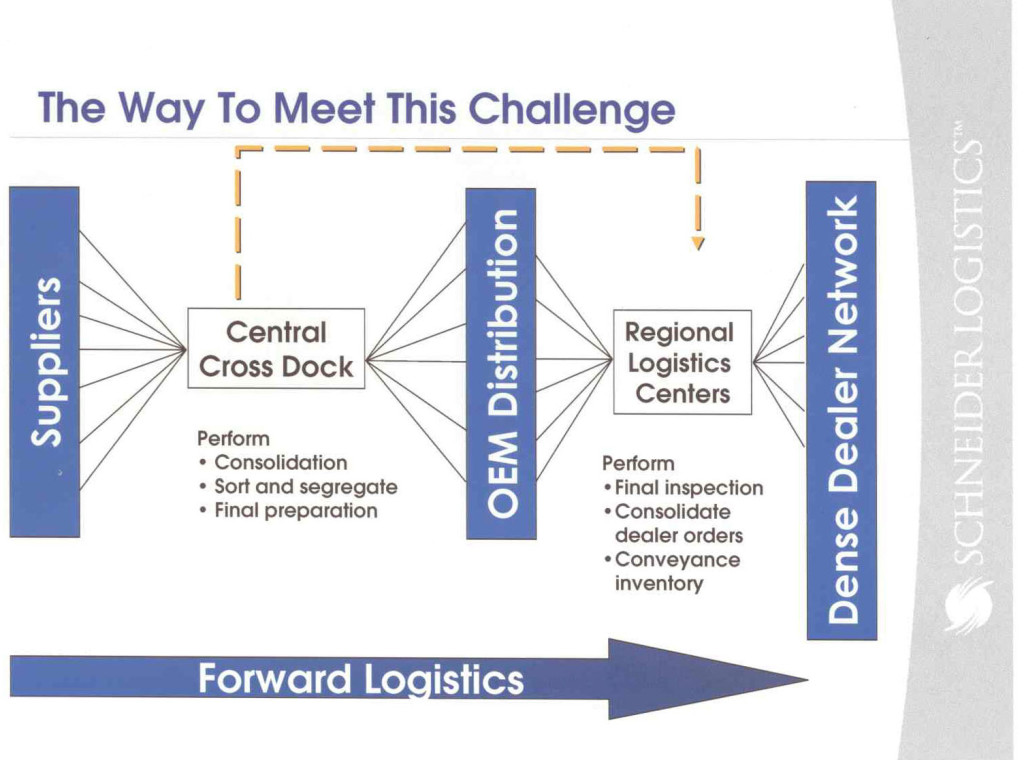

During the process of putting Ford’s network together, Schneider has found itself with a repeatable system. Fact is that most Ford, GM and other car dealers occupy the same metropolitan areas. Since the auto companies don’t compete with each other on spare parts, it is logical for them to share costs and distribution networks. Schneider Logistics is now actively selling this model in which automotive suppliers ship to Schneider Logistics cross-docks. Schneider Logistics cross-docks the parts into shipments for final delivery distribution centers. At the final delivery DCs, the shipments are loaded on and delivered by Schneider Logistics-controlled dedicated contract carriage. Schneider Logistics’ diagram of this process is shown below.

Schneider Logistics also realizes that the approach works readily for reverse logistics. It plans to make reverse logistics a standard part of the service offering.

Ford and GM are already sharing trial consolidated delivery routes from Portland and Denver. All of the Ford companies already commingle. Schneider Logistics will be adding other automotive OEMs over the next year as it extends its dominance in North American service parts logistics.

Sources: A&A Primary Research, http://www.schneider.com/