UTi India – Emphasis on Growth

December 6, 2011

By

Richard Armstrong

Attendees:

Vikram Paul, Managing Director – India & Regional Vice President – India Subcontinent

Brian Dangerfield, President – Asia Pacific Region

Hari Sivaprakasam, Director – Contract Logistics & Distribution India

Hariharan .P, General Manager – Contract Logistics (Solutions)

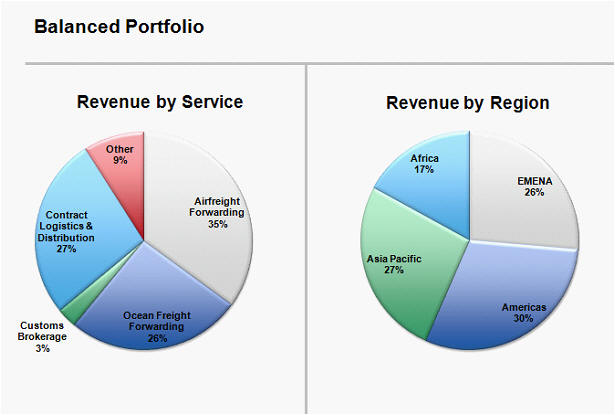

UTi’s strength in India starts with airfreight forwarding. UTi has ranked No. 1 for airfreight export tonnes for several years. In addition, its ocean freight volumes have been respectable. The segment which has lacked in comparison with UTi’s global picture is contract logistics.

Over the last two years, UTi expanded its contract logistics operation. Under the direction of Ed Feitzinger, added as executive vice president of global contract logistics in 2011, UTi has introduced a major effort to double the size of contract logistics in India in 2012-13.

Leading the effort will be Hari Sivaprakasam, a 31-year-old, Georgia Tech Masters Degree graduate who has been with UTi for nearly 10 years. Sivaprakasam was born in Chennai. He has experience with many of UTi’s largest accounts including Diversey for whom UTi provides all the parts for global supply chain management.

Sivaprakasam will be reporting to Vikram Paul, managing director of India and regional vice president. Paul is a modern, aggressive, 42-year-old COO. Like Sivaprakasam, he is bicultural and a part of the move to modernity in India.

The major challenges in India include lack of highways between and within cities, over capacity ports and India’s famously cumbersome and large governmental bureaucracy. Traditional corruption complicates business and everyday life. However, gross domestic product (GDP) growth will exceed 8% again this year and India’s establishment is changing. During our visit, Anna Hazare was leading an effort to force governmental reform of corruption. Hazare was on an extended Gandhi style fest.

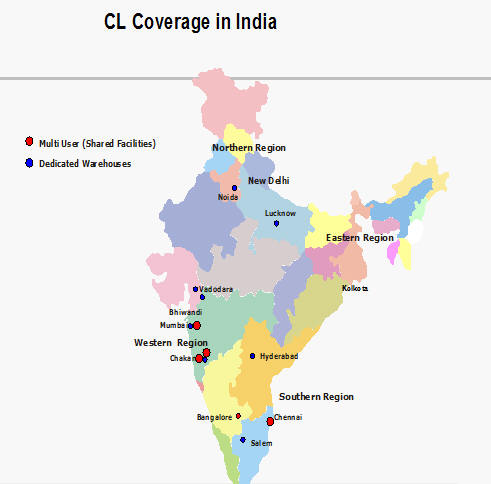

In India, most large retailers have many (20-24) smaller distribution centers to avoid heavy goods services taxes incurred in moving product across state lines. There are 30 states. Currently, there is a movement to make the goods and services tax (GST) uniform across the states which would allow most companies to reduce their number of distribution centers. In addition, major highways are being built for the “golden quadrangle” that will connect the major cities and regions. The major areas are the North Central based on New Delhi (population 22 million), the Western region with Mumbai (population 20 million), the Nation’s economic center and major port as its hub, the Northeast around Kolkata (population 15 million) and the South including the key city of Bangalore (population 7 million) and the second largest port of Chennai (population 7 million). Traditionally, Colombo at the north tip of Sri Lanka has been a key port of call for major shipping lines. Much of the Indian East Coast container movement is reloaded to larger vessels there. In addition, Kolkata is a shallow water port and Chennai is over capacity. A fourth port is being built in Mumbai to handle its current over capacity situation.

Most inland linehaul between major ports and markets is performed by container or trailer on flat car (COFC/TOFC). For truckers, operations are complicated nearly everywhere by lack and quality of the road network. Restrictions, such as the limitation on truck traffic in Mumbai between 6 AM and 6 PM, make for additional operating challenges.

An indication of India’s market growth potential for the next several decades is that 30% of the population is 14 and under. The mean age is just over 26 years. The market expansion opportunities are huge for a 3PL like UTi.

A Note on UTi’s Asia Pacific Operations

UTi’s APAC region operations are among its best. Airfreight is the strongest offering. Ocean freight is solid. Contract logistics is improving and growing. The China and Korea value-added warehousing has improved most rapidly. There are 3,240 employees of which 600 are in contract logistics. There are many more employees on contract payroll for contract logistics due to labor regulations in many countries including India. Traditionally, there has been a balanced emphasis on air/ocean/customs. As with all freight forwarding-based 3PLs, sometimes one or all of the forwarding services are purchased by a customer who may or may not want contract logistics coverage. Also, the 3PL may handle imports, exports or both. As we have seen elsewhere, the major global supply chain managers are consistently working side by side for major accounts.

UTi’s Asia Pacific president is Brian Dangerfield, a genial New Zealander who cannot do standup comedy like Rodney did. He does, however, run solid, profitable operations and is a capable, low key team leader. UTi APAC has gross revenue of $1.2 billion with net revenue of $218 million. Contract logistics generates 55% of net revenue globally but only 14% in APAC. For all business units combined, APAC’s gross margin is 19% and the ratio of operating income to new revenue is 27%.

Contract Logistics in India – Hari’s Challenge

In India, UTi Contract Logistics has 17 warehouses with 300,000 square feet of space and 30 customers. Hari Sivaprakasam leads an effort to achieve 50% revenue growth each year for the next two years. To achieve these results, Hari will add a couple of key personnel to his core group making it self-sufficient within India. An emphasis will be placed on building more long-term, partnership arrangements especially with global customers. Making this transition in India can be done more quickly due to the low level of facilities and operational quality in most of the market. Simply put, the plan is to provide quality contract logistics solutions like those found in other major markets.

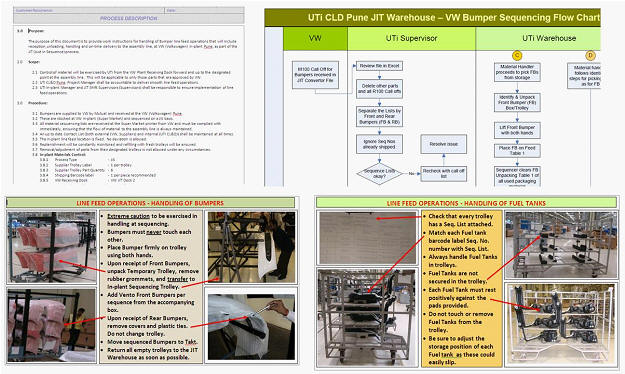

UTi has moved in that direction with many of its current operations. At Chakan, in the Pune auto assembly plant area, UTi operates a sequencing center for Volkswagen assembly plant suppliers. The modern Chakan VW assembly plant opened in 2009 and is producing four models right now (Polo, Vento, Fabia and Rapid).

UTi’s Vertical Approach Enabled Volkswagen JIT Program in Chakan

UTi’s involvement with Volkswagen in India started in September 2009 when UTi was asked, through its vertical leadership, to start working with Tenneco providing warehousing and sequencing services for the supply of exhaust systems to the VW manufacturing plant. Today, UTi services 11 key Volkswagen suppliers and manages the just-in-time (JIT) delivery of the following parts:

| Parts | Suppliers |

|---|---|

| Door Trim Panels | Motherson Sumi Systems Limited |

| Instrument Panels | Visteon |

| Wiring Harnesses | Tata Yazaki AutoComp Limited |

| HVAC Units | Behr |

| Front & Rear Bumpers | Mutual Industries Limited |

| Fuel Tanks | Yapp Zoom |

| Exhaust Systems | Tenneco |

| Seats | Lear Corporation |

| Headliners | IAC |

| Mirrors (ORVM) | Tata Ficosa |

| Middle Consoles | Minda |

Three-Way Relationship

In India, the logistics market is still maturing and most of the outsourced relationships are for standalone services. This UTi operation is unique to the market as it provides an integrated JIT solution from VW’s suppliers to VW’s manufacturing line including supplier relationships, transportation, warehousing, sequencing, line-side delivery and value-added services. UTi has been nominated as the preferred JIT provider by VW though the primary contracts are with the suppliers and thereby provide quantified value to both the suppliers and VW.

Solution Scope

The supplier program includes the following material flows:

- Suppliers that are 10 km away from the VW plant are routed through the UTi Sequencing Center wherein the scope includes primary transportation from the suppliers to the UTi Chakan facility, storage, inventory management, sequencing, secondary transportation from the UTi Chakan facility to the VW plant and in-plant, line-side JIT delivery.

- Suppliers that are in proximity to the VW plant bypass the UTi Sequencing Center. The scope of work here includes transportation from the suppliers to the VW plant and in-plant, line-side JIT delivery.

In addition, UTi also performs some value-added assembly work and in-plant sequencing. The operation is spread over three shifts, employing over 150 people.

Systematic Approach to Start-up and OPS Management to Replicate Best Practices

In order to successfully set up this program, UTi was able to replicate its best practices in automotive through its proprietary eight step “Advance Quality Planning” (AQP) process. UTi has developed its AQP process in order to align operational processes, systems and approaches with its clients’ strategic and operational goals. This process focuses on proper planning, solutions design, failure modes and effects analysis (FMEA), control plan, execution plan, pre-launch and post-launch process validation and sign-off. The AQP output was the starting point for all operational process flows, work instructions and visual aids and has been developed in both English and Marathi (local language in state of Maharashtra) as illustrated in the following graphic.

At Chakan, UTi also runs multi-client warehousing for non-VW customers. The total space at Chakan is 105,000 square feet with 1,000 in-block positions, six normal docks with dock levelers and other standard features. Security is good. The location is also fenced, has a warehouse management system (WMS) and value-added services.

For JIT operations, UTi has deployed 10 30-foot closed containers for primary transportation which make 25 round trips per day from suppliers to the UTi warehouse. In secondary transportation, UTi has deployed 20 small trucks which make 180 round trips per day to cater needs to VW.

For the French company Legrand, UTi operates warehouses in Bhiwandi and Chennai. Legrand’s products are electric wiring and related devices used for convenience and security in modern homes. Legrand’s products are of very high quality and highly preferred in the Indian marketplace. Legrand is also growing at a very healthy rate in India. UTi has been serving Legrand in India for nearly three years now. The Bhiwandi Warehouse, which is located just outside Mumbai, serves as Legrand’s National Warehouse replenishing regional warehouses across the country. The Bhiwandi Warehouse also caters directly to Legrand’s Central region customers. Inbound shipments are mostly in carton and pallet quantities and outbound shipments are in pallet, carton and each quantities. Eaches are picked and packed according to requirements. UTi’s WMS is fully integrated with Legrand’s enterprise resource planning (ERP) system MAPICS. This operation is 70,000 square feet and currently employs around 80 people. UTi, in July/August of this year, started up operations for Legrand in Chennai. This is one of Legrand’s Regional Warehouses and services its Southern region Customers. Both Bhiwandi and Chennai warehouses are multi-client operations and shared with other UTi Clients.

Here are the basics for the Chennai facility:

UTi has other well known clients in India including CNH, Endress+Hauser, Monsanto, Polycom, Siemens, etc. As Hari’s team and India move forward, the quality and complexity can be expected to move increasingly to First World levels.

Freight Forwarding UTi – India

Sunil Vaswani, Director – Ocean India Subcontinent

Paresh Kapadia, Director – Customs Compliance & MR Quality

Sunil Vaswani supplied the following background:

Mumbai has three terminals at its Nhava Sheva Port. They are run by A.P. Moller – Maersk, DP World and the Indian Government. Currently about 4.3 million TEUs (20’ trailer equivalent units) are handled. Capacity is about three million. A fourth, larger terminal is being built which will raise capacity to eight million. Most inland container movement is by train. The total India TEU count is eight million a year.

Up the coast (north) there are two smaller ports, Pipavav and Mundra. They are run by A.P. Moller – Maersk and DP World, respectively. These two ports are primarily used for New Delhi traffic. Again inland traffic is primarily COFC.

The major ship lines all call at Mumbai Nhava Sheva. Many also serve Chennai (1.5 million TEUs). Feeder vessels from Chennai and Kolkata generally transship containers over to Colombo in Sri Lanka setting up joint linking from India’s East Coast. Some cargo also gets relayed over Singapore. This traffic pattern adds time and cost. Kolkata has draft and silting problems. As a result, it becomes less and less of an option.

UTi maintains rate sheets with Maersk, Safmarine, ZIM and CSAV for Europe. Maersk, Safmarine, CMA CGM, and Hapag-Lloyd are the primary U.S. connections. Safmarine and MSC are used to Durbin and Cape Town, South Africa.

Rules for transportation are on the back of the bill of lading. Rate sheets and bill of lading rules cover nearly all full container shipments. Project and break-bulk traffic requires additional adjustments.

For global shippers, UTi provides door-to-door rates including inland transportation, customs clearance, duty drawback, etc.

UTi buys capacity from the container lines usually month by month. There are not any hard and fast rules. Normally pricing for global customers will be negotiated yearly with base rates being fixed and bunks (fuel surcharge) rates being variable. However, each customer can be handled differently.

Most of the business is 20′, 40′, 40′ high cube dry and reefer containers. Reefers are used for pharma customers like Ranbaxy. Reefers constitute about 20% of UTi’s total volume of 18,000 containers for export and imports.

India started the conversion from break-bulk to containerized freight in the late 1970s.

Airfreight

UTi bought Indir in 2004 which added significantly to export volumes. UTi has been the largest airfreight forwarder in India for most years in the last decade. Exports are 26,000 airfreight tonnes from 48,000 shipments (average 542 lbs). Imports are 11,000 airfreight tonnes from 30,000 shipments (average 367 lbs). There is very little contracted aircraft business like that from Hong Kong and Shanghai. About 15 to 16 different air carriers are used.

Customs and Paper Flow

Paresh Kapadia manages the customs brokerage process for UTi. Paperwork preparation is outsourced to an Indian company specialized in back office operations. For many inbound shipments (air and ocean), customers come in after notice of customs clearance, pay the bill and get a clearance receipt to tender for the goods.

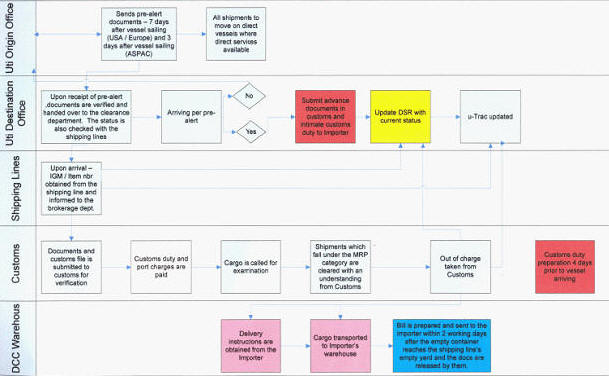

Shipments are controlled through use of paper folders following standard freight forwarding practice. At UTi the folders are green for ocean imports, yellow for air imports, red for air exports and blue for ocean exports. Detailed shipment information on physical handling and supporting documents is recorded for all documents. Export shipment folders include cost and pricing information. The processes for each type of forwarding are standardized and comprehensive. As an example, the ocean import process is diagramed below.

Ocean Import Process

For air exports, the standard list of documents is as follows:

- SHIPPER BILL

- OVERSEAS BILL

- COSTING SHEET

- MAWB COPY

- HAWB COPY

- INVOICE

- PACKING LIST

- MANIFEST

- GSP OR CERTIFICATE OF ORIGIN

- SHIPPING BILL

- SDF

- ANNEXURE I & II & C-1

- CUSTOM ATTESTED INVOICE

- CUSTOM ATTESTED PACKING LIST

- GATE PASS – TC

- FACTORY INVOICE

- LABEL INSTRUCTION

- SHIPMENT BOOKING COPY

- CUSTOMER REQUIREMENTS

- NCR

- PRE ALERT TO SHIPPER & OVERSEAS

- OTHER PAPER

- QUOTATION

- FUMIGATION CERTIFICATE COPY

- S/B CHECKLIST

- SLI

- WAREHOUSE SHEET

As part of the process for each shipment, UTi regularly uses electronic feeds to airlines and customers so that security and visibility issues are properly addressed.

Summary

India has been singled out as one of UTi’s Contract Logistics primary growth opportunities. The emphasis will be on growing with customers who can take advantage of modern, value-added warehousing and UTi’s integrated solutions. Hari Sivaprakasam has his work cut out for him but he’s a good match for it.

Sources: A&A Primary Research, https://www.us.dsv.com