Transplace’s Buyout Reinvigorates its Growth Strategy

Lowell, Arkansas USA Site Visit

February 22, 2011

By

Evan Armstrong

Key Transplace Personnel:

Tom Sanderson – President & Chief Executive Officer

George Abernathy – Executive Vice President & Chief Operating Officer

Vincent Biddlecombe – Executive Vice President & Chief Technology Officer

Matthew Menner – Senior Vice President, Sales and Alliances

Ben Enriquez – Country Director, Mexico

Cindy Winkel – Vice President, Business Intelligence

Jose Minarro – Managing Director, Customs Brokerage (Mexico)

Sheila Hewitt – Vice President, International Services

Troy Ryley – Managing Director, Transportation & Distribution (Mexico)

Transplace Company Overview and New Ownership Structure

Transplace is a leading U.S. headquartered non-asset based transportation management third-party logistics provider (3PL). From its founding more than a decade ago, it has rapidly developed into one of the leading domestic and increasingly global transportation network managers. In December 2009, New York-based private investment firm CI Capital Partners, LLC, a group of key Transplace executives, and two outside investors acquired Transplace from its remaining founding owners. The new ownership structure incentivizes Transplace management to significantly expand operations and supply chain management capabilities. Its targeted growth will come from simultaneously executing organic and acquisition strategies.

The Transplace service portfolio has expanded significantly over the past few years and now includes: lead logistics provider (LLP) capabilities, network transportation management, supply chain consulting, hosted/on-demand TMS technology, freight brokerage (TL, LTL and Intermodal), and international transportation management services. Key strategic accounts include: Anna’s Linens, Del Monte Foods, Glatfelter Paper Company, Office Depot, RockTenn, and Sunny Delight Beverages.

While the overall U.S. Domestic Transportation Management market declined 15.1% from 2008 to 2009*, Transplace was able to significantly increase its year-over-year performance. It managed over $3 billion in transportation in 2009 and processed over four million shipments. Its operations generated approximate gross revenues of $990 million and net revenues of $70 million representing greater than 10% growth over 2008 from its staff of just over 500 associates. Recent customer additions include: Cox Communications, DS Waters, Huhtamaki, Pace Industries, and SPX Cooling Technologies.

The backbone for Transplace’s operations comes from a web-native, proprietary, on-demand transportation management system (TMS) platform. The TMS has a comprehensive functionality set for daily transportation planning and execution. While the core TMS components have been in place since Transplace’s founding, the company has recently been focusing a significant amount of internal resources on developing advanced business intelligence and analytical reporting functionality for internal use as well as for customers. For example, below is an example of a report showing a customer service dashboard for a consumer packaged goods (CPG) Transplace customer.

Transplace’s Online Business Intelligence CPG Customer Service Dashboard Report

It details on-time deliveries using multiple metrics, charts late deliveries by reason, and highlights the most challenging transportation lanes.

Other standard business intelligence reports/dashboards include:

- Executive Summaries of volume and cost information by mode

- Cost Maps showing transportation costs between points on a map that allows for “drill downs” to more detailed information

- Carrier Scorecards that track on-time service, shipment tender acceptance, and check-call reporting percentages

New Targeted Spot Market Transportation Management Offering

Like most transportation management 3PLs, Transplace has learned the strategic importance of having a base of transactional spot market business in addition to its contractual network transportation management accounts. This was especially true in early 2010 as carriers increased their rates faster than 3PLs rates could be increased to customers. In the spot market, this rate increase lag and resulting margin compression is nullified since carriers’ rates and the market rate paid by customers move freely with between carrier capacity supply and freight services demand. Furthermore, Transplace also sees the spot market as a way to meet the needs of smaller and mid-sized shippers and to gain additional visibility to true market pricing by lane and mode.

Transplace developed and launched its new targeted spot market transportation operations in March 2010. After six months of planning, the operation opened near the company headquarters in Dallas. It is currently staffed by six managers and 14 operations personnel. The operations personnel are split between customer sales and carrier capacity buying at a 2:1 ratio. Since its inception, this Freight Services team has handled shipments in the following transportation modes: Truckload (Dry Van, Reefer), LTL (Dry, Reefer), Intermodal, Specialized, Domestic Air, Ground Expedite, Parcel (in select markets), and Local Cartage (in select markets).

Transplace Mexico Gains Traction

In February 2008, Transplace founded its Mexican operations by establishing two entities: Transplace Mexico, LLC and Transplace de Mexico S. de R.L. de C.V. To lead its new operations, Transplace hired industry veterans Troy Ryley and Jose Minarro who were both ex-managers for Expeditors International in Mexico. It has grown fast with an operating staff of 27 and target revenues of $22 million for 2010.

The operation’s key service offering includes cross-border and intra-Mexico over-the-road transportation management, U.S. and Mexico customs house brokerage, border processing, warehousing and distribution, secure products transportation management, ocean and airfreight management, technology solutions (TMS), and consulting. Modes handled in its land transportation management operations include: dry van, flatbed, refrigerated/protective service, and intermodal.

Transplace Mexico’s warehousing and distribution operations include a 110,000 square foot facility in Laredo, TX; 40,000 square feet in Monterrey, MX and 25,000 square feet in Mexico City, MX. A warehouse in Guadalajara has also been added. Transplace currently runs a transportation management operation in Guadalajara and has sales offices in Mexico City, Nuevo Laredo, Monterrey, and Puebla. Its internal and contracted agent network is detailed in the figure below.

Transplace’s Mexico Operations and Sales Locations

Its shipment volumes have been growing steadily, and Transplace Mexico managed approximately 12,400 cross-border truckloads in 2010. It is currently managing 480 intra-Mexico truckloads per month and managed over 10,800 loads in 2010. Transplace Mexico also managed 9,475 customs house brokerage entries in 2010 and is seeing moderate growth in its ocean and air freight forwarding business. Key Mexico customers include: AutoZone, Cott Beverages, Dole, Guardian Building Products, Microsoft, NxStage Medical, Pace Industries, Port-A-Cool, Sunny Delight, The Home Depot, and UFPC.

Lean Six Sigma Management

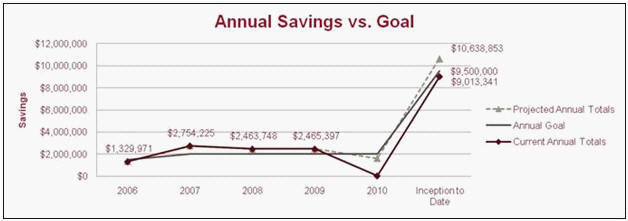

When we visit 3PLs, very few mention lean six sigma process improvement methodologies. And even fewer are actually managing a true lean training and management process. Since 2005, Transplace has adopted and instilled a lean six sigma culture and has seen some meaningful and direct benefits. To spur the lean culture, Transplace has developed a full lean management training program, in conjunction with outside management consultants that specialize in lean, and to date has developed 53 green belts, six certified black belts, one master black belt and an executive program sponsor. More importantly, from improvement projects led by Transplace employees or in conjunction with customers through a joint project approach, Transplace has achieved significant cost savings. These are shown in the graph below.

Lean Six Sigma Savings

The following case studies highlight how Transplace has worked with its customers to improve their supply chains.

Del Monte Foods Case Study

Del Monte Foods is best known for its pet products and consumer foods businesses. Its popular brands include: Meow Mix, Kibbles n’ Bits, Del Monte, and StarKist. Its retail customers include Wal-Mart, Costco, and Sam’s Club. Approximately 90% of Del Monte’s sales are in the U.S. and solid domestic transportation management is a key to its success.

Prior to engaging Transplace, Del Monte was having significant problems in meeting its transportation and stocking requirements for Wal-Mart. Del Monte’s two main logistics management performance measures for Wal-Mart are an on-time delivery service goal of 96% – which includes all shipper and transportation related service failures measured against the “Must Arrive by Date” – and having 55 or fewer distribution center (DC) stock outs per month.

In 2006, to address these issues, Del Monte replaced its incumbent 3PL with Transplace for domestic outbound to retail customer DC shipments. Del Monte’s shipping locations include 27 DCs, multiple plants and co-packers. Transplace set up a dedicated retail customer service team for Del Monte in less than 60 days that began with managing a portion of its domestic transportation in July 2006. The current Transplace operation has an approximate staff of 16 (a number that is constantly weighed and reduced based on continuous improvements through operational and systematic efficiencies). The team manages over 200,000 annual outbound/replenishment shipments via truckload, intermodal rail, conventional rail (boxcar) and less-than-truckload (LTL).

Transplace worked with Del Monte to improve its customer service levels and capacity planning for peak volume seasons. Del Monte experiences three main annual volume peaks: packing season, peak demand season and quarter ends. Working together, an ongoing process for capacity planning–which confirms available transportation capacity against demand forecasts–was developed and implemented by Transplace. After one year of use, the new process significantly reduced the costs for premium/expedited freight compared to the previous year’s benchmarks. Also, Del Monte experienced no transportation delays from transportation equipment issues for shipments destined to its manufacturing facilities. The responsibility for the capacity planning activities has now been fully migrated to Transplace.

In addition, Del Monte no longer has any issue with reaching and maintaining the two main logistics measures set by Wal-Mart. By placing a dedicated Customer Service Manager at Del Monte’s Bentonville, AR office and increasing supply chain visibility through reporting, Transplace has helped Del Monte’s on-time delivery service levels improve from under 90% to more than 98% on-time for 2009. In addition, Del Monte’s stock out performance requirements are now met on a consistent basis.

Summary

Transplace has expanded its service offering and capabilities. Its combined flexible customer solutions and lean six sigma process improvement approach are helping to drive Transplace’s growth as a leading North American and increasingly global transportation management provider. Its Mexican and international service offerings are providing Transplace with key operations in higher growth developing markets. Through its recent buyout, reinvigorated approach to growth, and Transplace’s increasingly focused business strategy, we anticipate that it will to continue to develop and build upon its market position as a leading transportation management services-centric 3PL.

*Source: Armstrong & Associates, Inc. 3PL Market Analysis Report: “Restoration 3PL Market Analysis and 2010 Predictions”

Sources: A&A Primary Research, http://www.transplace.com/