Ryder Helps Apria Healthcare Redesign its Supply Chain

Irvine, California USA Site Visit

October 15, 2013

By

Evan Armstrong

Key Personnel:

Stephen Dean – Senior Vice President, Sales and Marketing, Ryder Supply Chain Solutions

Kyra Sweda – Director of Business Development, Ryder Supply Chain Solutions

Jack Baikie – Chief Procurement Officer, Apria Healthcare

Jim Chung – Vice President of Supply Chain, Apria Healthcare

Mike Gerry – Director of Supply Chain Technology, Apria Healthcare

Jerry Heller – Branch Manager, Apria Healthcare

Ryder’s Supply Chain Solutions Overview

Ryder’s Supply Chain Solutions (SCS) division generated $2.3 billion in 2012 gross revenue and $1.9 billion in net revenue. It manages a warehouse network of 233 facilities with over 31 million square feet of space. Approximately 57% of its revenue is from dedicated services where Ryder SCS manages a fleet of 3,820 tractors, 604 trucks, and 6,535 trailers. Ryder is a lead logistics provider for most GM plants and services Chrysler/Fiat, Toyota and Honda plus a multitude of tier-one suppliers. Ryder is known for running first-rate inbound supply chain management programs, sequencing centers, just-in-time and dedicated contract carriage operations. Its Mexican operations are very good with revenues at $210 million a year.

In December 2010, Ryder acquired Total Logistic Control, a leading third-party logistics provider (3PL) in providing value-added warehousing and transportation management services to customers in the Food & Grocery and Retailing vertical industries. In January 2011, Ryder acquired two southern California dedicated operations to expand its presence in dedicated contract carriage in the West, as well as increase its customer base in the Retail industry.

Ryder Supply Chain Solutions/Apria Healthcare Supply Chain Redesign

Ryder has recently gained some traction in developing supply chain solutions for Healthcare industry customers. On a recent visit to the Los Angeles, CA area, we had the opportunity to meet with one of Ryder SCS’s new Healthcare customers, Apria Healthcare.

Apria Healthcare has over 13,700 employees in the U.S. and is a leading provider of home healthcare products and services with approximately 2.4 million patients cared for annually. It generated revenue of $2.4 billion in 2012 and is best known for its home respiratory products (including oxygen generating machines/concentrators and ventilators) where it is the domestic market leader.

The Irvine, CA Apria branch operation we visited has approximately 30,000 square feet of attached warehouse space and three dock doors. It works as a forward stocking location for Apria’s respiratory therapy and home medical equipment product lines. Apria maintains its own customer delivery fleet of trucks.

Apria’s U.S. distribution network for respiratory therapy and home medical equipment products includes seven distribution centers, a Bio-Med center, and over 420 branch operations locations within a 50-60 mile customer delivery radius.

Apria branch office rack storage locations

Apria Home Oxygen Concentrators

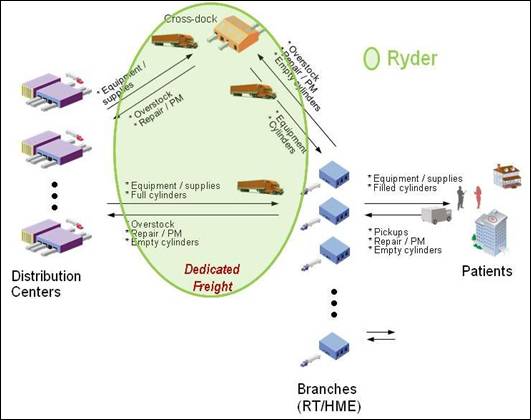

In October 2012, Apria contracted with Ryder SCS to provide dedicated contract carriage (DCC) dry-van truckload transportation services for products moving from its seven DCs and crossdock to its branch operations. As part of the operation, Ryder SCS also manages unattended deliveries, hazardous materials, product segregation and vendor returns. The initial scope of the Ryder Dedicated warehouse-to-branch transportation operation is shown in the figure below.

Initial Ryder SCS Apria Healthcare Dedicated Operation

Starting in 2013, Ryder’s national engineering team began its redesign efforts by analyzing Apria’s inbound supplier to DC channel to identify cost savings opportunities. At the time, the following problems were identified:

- Hundreds of annual direct shipments were being made by suppliers to Apria DCs.

- Suppliers were shipping too often (three or more times per week) to every DC.

- Less than 5% of shipments were moving on truckload pricing.

- There was overuse of unnecessary expedited freight.

- There was a large week to week variance in order/delivery volumes.

- Dedicated routes were running 50% empty in backhaul lanes and many ran near Apria suppliers.

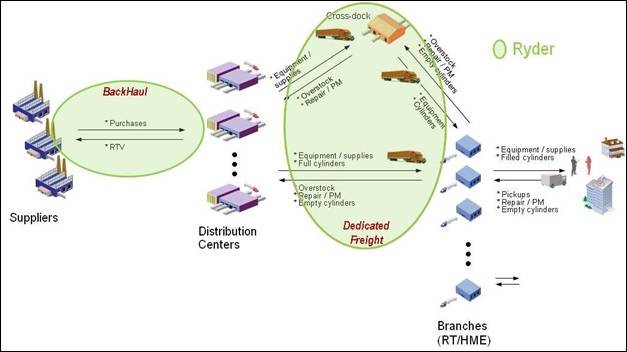

Using its transportation modeling software, Ryder’s engineering group and Apria collaborated to reengineer its network. They identified inbound routing and delivery optimization opportunities and supplier backhaul opportunities.

As the program with Ryder, Apria, and its suppliers gained momentum, significant costs savings were identified and operational improvements were implemented for Apria and its suppliers. The following actions were taken:

- The majority of inbound supplier shipments are now consolidated onto full truckloads (over 75% shipments now move at Truckload rates).

- Supplier shipment frequency has been reduced to one to two times per week to each Apria DC.

- Expedited freight has been greatly reduced and now the standard shipment method is standard truckload and less-than-truckload.

- The network has been further optimized by filling Ryder’s dedicated operation’s backhaul lanes with inbound shipments from suppliers to Apria DCs.

Redesigned Ryder SCS Apria Healthcare DCC Operation

Through its supply chain redesign efforts, Ryder’s dedicated fleet for Apria has been reduced to 24 tractors, 39 trailers, and 30 drivers. Ryder handles about 325 shipments/90 truckloads per week for Apria and its routes vary week by week. While Apria hired Ryder Dedicated for its core transportation services, Ryder SCS also plays a significant role with additional transportation management services for a broader supply chain solution.

From the collaborative redesign, Apria will realize the following cost savings for 2013 and 2014:

- Dedicated transportation cost savings via engineering optimization

- Improved backhaul utilization

- Fuel savings through Ryder’s “OPIS” program

- Reduced carbon footprint

According to Jim Chung, vice president of supply chain at Apria, “Ryder is an integral part of Apria’s supply chain. Their engineering competency along with the portfolio of capabilities allow Apria and our key suppliers to collaborate and develop the freight network solution that is revolutionary to the home healthcare industry.” He added, “During ‘Superstorm Sandy’, Ryder’s capabilities really shined. Apria had a critical need to send emergency fuel to affected branches in the area so that we could service our patients affected by power outages, and Ryder was able to quickly dispatch necessary assets from nearby regions to help accomplish this critical mission.”

Ryder SCS Operations Review Summary

Ryder SCS is making significant inroads into Healthcare with customers such as Apria. Through process improvement and transportation optimization, it will realize over $1 million in annualized savings. With these types of supply chain management examples, Ryder has developed a solid position for securing future Healthcare customer business.

Sources: A&A Primary Research, http://www.ryder.com/