Penske Team Defeats Brazil’s Complexities

Brazil Site Visit

May 26, 2011

By

Richard Armstrong

Attendees:

Joe Gallick, Senior Vice President, Sales

Cristiano Koga, Director, Sales and Engineering

Lucas Lima, Manager, Logistics Engineering and Quality

Fabricio Orrigo, Commercial Manager

Penske’s South American management team is made up of educated, young executives who handle Brazil’s logistics hurdles. They were trained in engineering based fields and are very personable. Koga is an experienced logistics executive with real sales skills. Orrigo is a steady, conscientious manager of Penske’s multi-client warehousing. Lima understands and engineers solutions with a specialization in solving Brazil’s byzantine transportation maze.

The Challenge

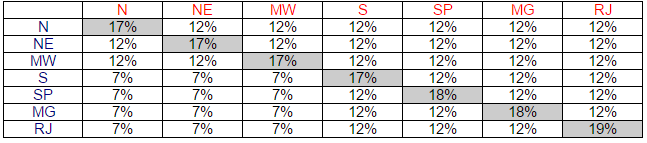

Transportation management in Brazil is measured in CTRC’s and value of shipments. CTRC’s look like U.S. freight bills of lading but include additional fields for the value of commodities shipped, the value-added tax on freight and the value-added tax (ICMS) on commodities shipped. Value-added taxes (VAT) range from 7% to 19% by state (Brazil has 26 states). In general, underdeveloped areas like northern Brazil have low rates while Sao Paulo and Rio de Janeiro which account for over half of GDP (gross domestic product) have the highest rates. Incentive reductions in the VAT are used as subsidies for poorer states and attract new companies to generate jobs and revenue. For example, pharmaceuticals are cheapest if shipped from Goias where Anapolis is a warehousing hub. The transportation manager needs to routinely balance transportation costs against VAT on commodities to achieve the lowest overall cost solutions.

ICMS Tax Rates

Penske, as the transportation manager, sometimes advances the tax portion and always tracks debits and credits for every shipment. Penske’s CTRC information must be filed with the origin state government before shipment. After the shipment, it is used as proof of delivery to insure VAT payment to the destination state. Not surprisingly, the ICMS VAT amounts are often greater than transportation revenues. At times circular or non-sensical movements on a transportation basis are made to minimize VAT requirements. Movements of return goods, cages, pallets, etc. are handled on the same value-added paperwork basis. But the best is yet to come.

In order to provide employment and an alternative to slash and burn agriculture in the Amazon basin, a Free Economic Zone was created in Manaus called PIM (Polo Industrial de Manaus) which is mainly focused on consumer electronics and the motorcycle market. Products manufactured in the zone are tax exempt. To take advantage of the cost savings, household names like Honda, LG, Samsung, Sony, Whirlpool and Yamaha are among the companies who have brought jobs and modernization to Manaus.

Following in the historic pattern of solving the logistics pieces last, extensive challenges have had to be solved. The distance from Manaus to Sao Paulo, the major market, is 1,700 airline miles. One uses airline miles because there are no connecting highways or rail lines. The normal pattern is to use barges to handle about three dozen trailers of manufactured product at a time from Manaus to the port city of Belem (»770 water miles). From Belem, the containers move by truck to Sao Paulo (1,860 miles). There is no intermodal alternative because there is no railroad. The transit time is three to four days to Belem and seven to eight days to Sao Paulo. Once the distribution centers are reached in Sao Paulo, product is often distributed back north. Not surprisingly, theft is a problem and losses run in the millions. (Penske does not control the Amazon River barge movements). Given the lack of infrastructure and economic redistribution consequences, it requires transportation management mastery to get the job done. Optimizing on the established basis of transportation costs alone, as in North America or Europe, is a prescription for disaster. Both transportation and VAT have to be traded off and maximized and that requires skill. At the same time, the barriers erected provide Penske with value-added opportunities for customers who want expertise and a lack of complications with the Brazilian government. Some industrial consumer companies have chosen the city of Recife in the state of Pernambuco in the northeast part of Brazil to open new DCs (distribution centers) to reach out an emerging middle class faster.

Penske’s Engineered Solutions

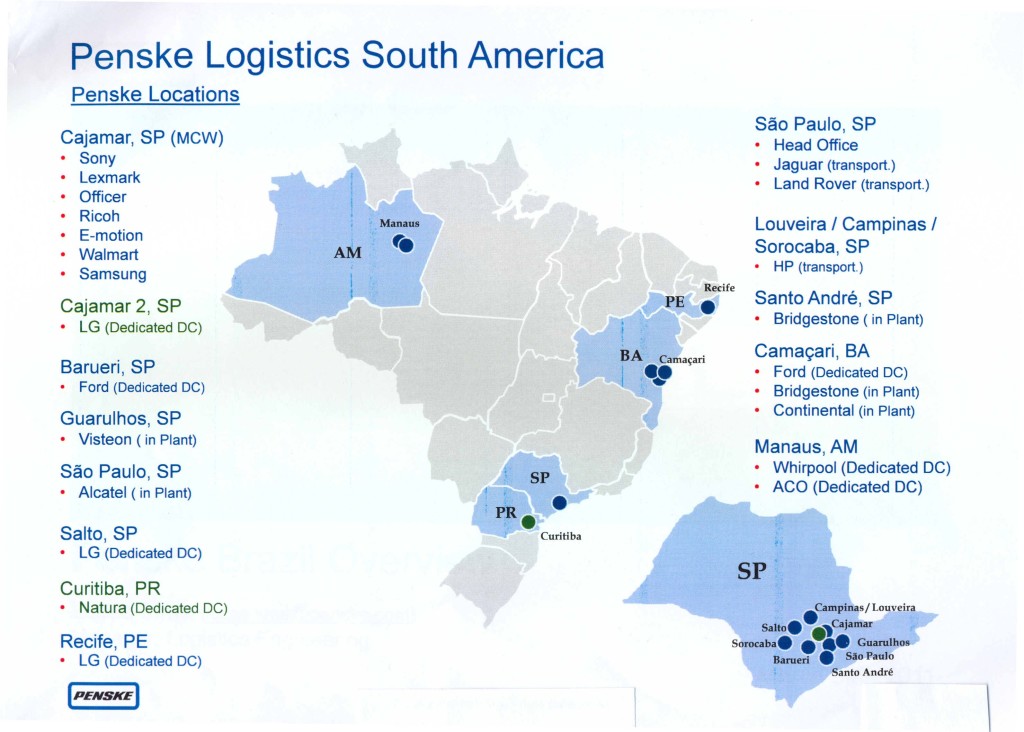

Penske began operations in Brazil in 1998. It now has 1,950 employees, 19 large customers and 13 warehouses with 3.4 million square feet of space. On average 25,000 CTRC’s, combined freight and VAT billings with a value of $250 million, are processed each month. CTRC’s are normally billed with four copies and a standardized invoice used as proof of delivery for the tax collector.

Ford, for whom Penske is a Lead Logistics Provider and consistent award winner, is a top customer. Other household name accounts are Bridgestone, Lexmark, Sony and Wal-Mart. A major new dedicated DC is being opened for LG in Cajamar. Here is the layout:

As part of its detailed, modern transportation and supply chain management, Penske uses 18 primary trucking companies. These include Rapidão (pronounced Happy Don) Cometa, Company and Plimor – all well known and reputable Brazilian carriers. Communications with these carriers, as with shippers, is done by EDI (electronic data interchange) or other electronic means as much as possible. Internet track and trace and GPS (global positioning system) locating are standard parts of the Penske offering.

Penske runs high security warehousing operations equipped with television monitors and other electronic technology. Properties have high fences and check-in locations have full body turn-styles. Guard shacks have bullet proof glass and small openings for passing documents back and forth. Inside warehouses, caged areas with limited access are common. Loading situations are controlled using gated containment areas at some locations for shipments which are then loaded by drivers. Television cameras for remote monitoring cover locations inside and out.

A Penske Brazil Warehouse

Entrance Gate to the Warehouse

Penske runs high security, stand alone DCs for Ford (two locations), LG (three), Alcatel, Natura and Whirlpool. Consistent with its history of supporting manufacturing, it has in plant support for Visteon (auto parts), Bridgestone (tires) and Continental (tires).

Penske’s multi-client operation in Cajamar has three separate docks of about 175,000 square feet each. They have high ceilings, good lighting and are RF (radio frequency) equipped. The three separate docks are part of a huge warehouse condominium of 13 walled off separate docks. Each dock has 14 doors on a side.

There are three shifts with 400 warehouse personnel total as a base. The labor force swells to about 1,000 in the fourth quarter. End of the month and fourth quarter surges are strong in Brazil. Loading/unloading is live. For security reasons, trailer pools are not allowed.

There are 100 office and management personnel. Six are involved in freight bill payment, six in billing and 19 in track and trace. About 24,000 orders are processed per month.

There are two large screened areas with limited access – one for Officer (electronics) and one for Sony. Put-away is done on the first and second shifts, picking on second and third.

This facility has a screened training area which is a common and successful practice for Penske. The training area has a scale model of the warehouse, scanning guns, shelving, pallet blocks and other parts. New employees are taught how to work in the warehouse using the models. As they gain experience and become lead employees, they are assigned aisles of responsibility. Training challenges for Penske are that (1) only full-time employees can be used (Brazilian law forbids part-timers) and (2) a person laid off cannot be rehired under Brazilian law so there is a constant need for new hires.

Daily, start of shift team meetings often use flip charts to cover major issues. KPIs (key performance indicators) for Penske’s multi-client operation are consistently in the high nineties. Team work is stressed and labor relations are very good.

Sources: A&A Primary Research, http://www.penskelogistics.com/