OHL Team Ready for the Big Leagues

Brentwood, Tennessee USA

June 30, 2009

By

Richard Armstrong

Key Personnel:

Scott McWilliams, Chief Executive Officer

Bert Irigoyen, President & Chief Operating Officer

Frank Eichler, Chief Administration Officer & General Counsel

Catherine L. Cooper, Executive Vice President & Chief Information Officer

Bob Spieth, President – Contract Logistics

Denis Reilly, President – North America Transportation

Mick Fountain, President & Chief Executive Officer – Global Freight Management & Logistics

Charlie J. Cape, Phd, Chief Information Officer – Global Freight Management & Logistics

Michael A. Burns, Executive Vice President – Global Sales & Marketing

Fred Loeffel, Executive Vice President – Global Account Management

John R. Norris, Sr. Director of Business Development

Karen Hall, Director of Marketing & Communication

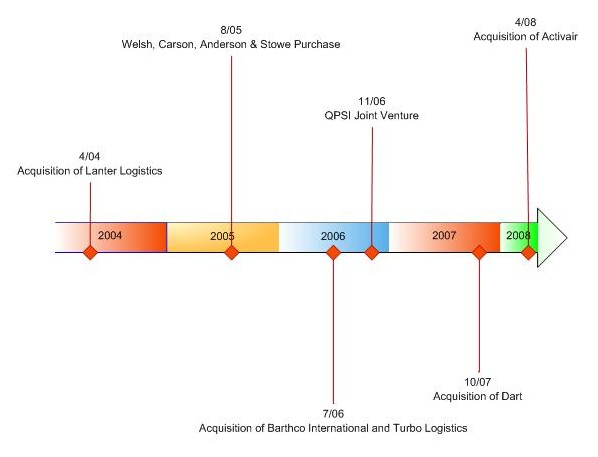

OHL is ready to be a global supply chain leader. Since 2006, when it acquired Barthco, OHL has quietly built a portfolio of global supply chain management capabilities that complement its well-known expertise in value-added warehousing and distribution. OHL has rounded out its leadership and operations teams to go toe to toe with any third-party logistics provider (3PL) in the industry. The team that CEO Scott McWilliams fields is particularly strong given its company size. However, that smaller size gives it flexibility and responsiveness to its target market of Fortune 500-1,500 companies.

A key member of the team is Mick Fountain, president & CEO of OHL’s Global Freight Management and Logistics business unit. Fountain learned the game at Lep Air Services, MSAS and DHL/Exel. OHL has built on the 2006 acquisition of Barthco, purchasing key offices of Hong Kong based Dart Express in 2007 and acquiring London based Activair in 2008. The company has 56 global locations and Fountain says that OHL needs 65 to complete the global network. He indicates that additional European locations will cement OHL’s ability to compete against the other global providers.

Figure 1 – OHL Timeline

Fountain’s group contains some key heavy hitters. Mary Jo Muoio, SVP, is the leader of OHL’s trade services group – a strong element of the international transportation management offering. Muoio is also president of the National Customs Brokers & Freight Forwarders Association of America. Including Muoio, OHL has 55 licensed customs brokers.

OHL currently handles 110,000 air freight shipments a year and 60,000 TEUs (twenty-foot equivalent units). The company anticipates clearing 500,000 U.S. Customs entries this year and had a 98.3% “correct as filed” accuracy rating last year. This compliance score is one of the best in the business. OHL will file approximately 100,000 ISFs (importer security filings) during 2009.

Michael Burns, EVP global sales and marketing, is an experienced and proven sales leader who worked in tandem with Fountain at Exel. Charlie Cape leads the deployment of the new Cargowise platform. The Cargowise deployment is about 90% complete, with some business modeling additions to be completed by year end.

Cape’s efforts are coordinated with OHL’s EVP and CIO, Catherine Cooper. Cooper is another of the entrepreneurs who joined OHL. She’s bright and quick and will continue to lead OHL and its customers to a one portal visibility system, slated for 2010.

Figure 2 – OHL Supply Chain Operating Systems

In addition to Global Freight Management and Logistics, OHL has two other business units – Contract Logistics and North America Transportation. Quality-wise, Contract Logistics belongs with a few consistent Class A value-added warehousing and distribution (VAWD) operations. OHL now operates over 120 warehouses with 28.3 million square feet of space. Besides North America, OHL has VAWD operations in Amsterdam, Shanghai, and Singapore. Twenty-two percent of the operations now involve fulfillment for the direct to consumer channel in which OHL has significant competency. In addition, OHL has developed a return logistics operation for a leading electronics manufacturer. One of OHL’s advantages comes from multi-customer campuses, with robust operations in Atlanta, Chicago, Dallas, Los Angeles, Memphis, Nashville, St. Louis, Sparks and other campus locations.

Back in the days when it was known as Ozburn-Hessey Logistics, OHL involved itself heavily in the real estate part of warehousing. McWilliams has moved steadily to an asset-light business model. These days, OHL’s building needs are handled by strategic partner, ProVenture Commercial Real Estate, which is also headquartered in Brentwood.

Over the last seven to eight years, OHL has developed a range of transportation service offerings. The key operating system is Oracle Transportation Management (G-Log). Denis Reilly is president of OHL’s North America Transportation (NAT) business unit. Reilly is a veteran of Menlo, USF, and YRC Logistics. Reilly has built a team of industry veterans with deep experience in selling transportation management solutions.

NAT’s engineering and analysis work features network optimization, facility location, model shifts, and route design. As part of its daily transportation management (TM) activities, OHL provides carrier management and shipment optimization and execution. The solutions offered are designed for customers with transportation spends of $3 to $5 million per year but are robust enough to handle larger operations. TM is a contracted service normally with 3 to 5 year terms. Control centers are operated in Nashville and Sparks.

Reilly’s group also runs a truckload brokerage operation. About 7,000 shipments are handled monthly with half requiring specialized handling such as refrigeration. These operations were expanded with the purchase of Turbo Logistics in 2006. OHL provides brokerage services for a leading soft drink manufacturer at 51 locations. The brokerage hub is in Atlanta.

NAT also operates a less-than-truckload, temperature-controlled network in the Midwest and Southeast. There are seven terminals in the network from Kansas City to Chicago to Atlanta. National coverage is provided with carrier partners.

OHL’s core business segments have a cumulative annual growth rate of 11.4% since 2005. Acquisition growth rates have been 4.3% for the same period, for a total growth rate of 15.7%. The growth rates are indicative of the core business strengths for Contract Logistics and NAT. Fifty percent of OHL’s business development spend per year is for new business startups. About 25% is for building new IT systems necessary for global supply chain management.

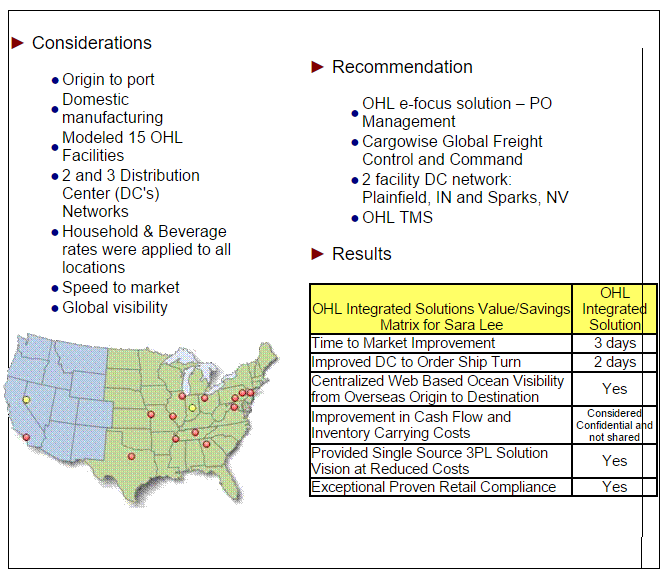

Fred Loeffel, EVP global account management, heads the cross-selling effort for OHL. Forty-one of OHL’s top 100 accounts are using the services of two or more business units indicating several early successes towards achieving OHL’s goals of providing complete supply chain solutions for its customers. Loeffel and his team recently designed an end-to-end supply chain solution for Sara Lee. Key results are outlined in Figure 3 below.

Figure 3 – OHL Solutions Approach and Results

OHL has the team, the momentum and the depth of expertise to sustain its growth and solidify an already strong position. It’s time to move into the big leagues.

Sources: A&A Primary Research, https://geodis.com/us