YRC Logistics Extends its Asian Supply Chain Network

Shanghai and Suzhou, China

October 2008

By

Evan Armstrong

Key Personnel:

Sean Burke, Vice President of Business and Services Development, YRC Logistics Asia

Michael Kleimeyer, Assistant General Manager, YRC Logistics/Shanghai Jiayu Logistics

Nancy Qian, Vice President, YRC Logistics/JHJ International Transportation Co.

Johnny Lau, Director of Key Accounts, YRC Logistics Asia

Lucy Liu, Senior Marketing Manager, YRC Logistics Asia

Tony Xu, Vice General Manager-Eastern China Company, YRC Logistics/JHJ International Transportation Co.

YRC Logistics is a rapidly growing third-party logistics provider. In 2007, it reached gross revenues of $998 million and net revenues of $623 million and had a global staff of over 4,100 employees. Key customers include: Clorox, Home Depot, Microsoft, Otis Elevator, Procter & Gamble, Timken, and Wal-Mart.

One of its major growth strategies has been to expand internationally into Asia. In 2005, YRC Logistics formed a (50%/50% ownership) joint venture with JHJ International Transportation Co., Ltd., a major China based international freight forwarder, and has since acquired Shanghai based less than truckload (LTL) transportation provider Shanghai Jiayu Logistics Co. Ltd. In a recent visit to Shanghai China, we had the opportunity to review YRC Logistics’ expanding Chinese operations.

YRC Logistics China Operations Overview

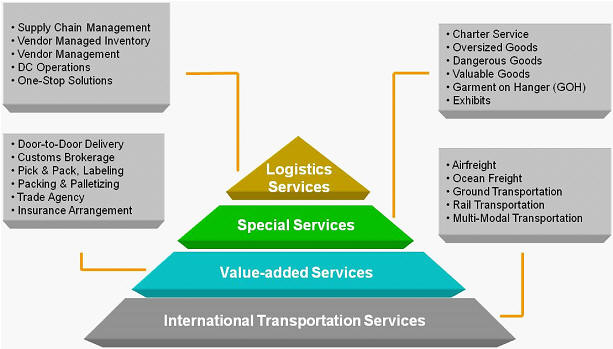

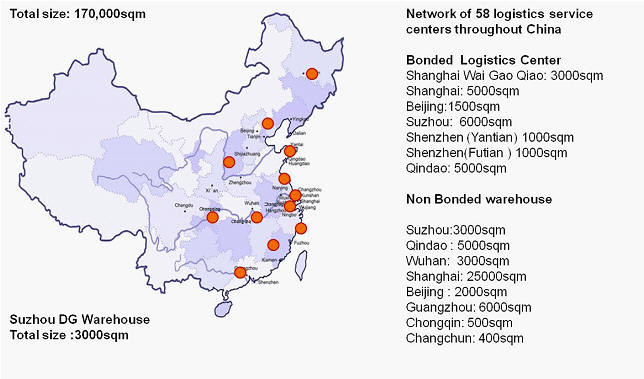

YRC Logistics/JHJ International Transportation (YRCL) is headquartered in Shanghai, China and has 68 locations in 30 cities. With annual gross revenues of approximately $440 million and a staff of over 1,400 employees, its key third-party logistics (3PL) services include international air and ocean freight forwarding, customs brokerage, and domestic warehousing and transportation management. YRCL is a Class-A forwarder and ISO 9000 certified. Its service portfolio is detailed in the figure below.

Figure 1 – YRCL China 3PL Service Offering