Meritor Targets the 3PL Market for Growth

Florence, Kentucky USA Site Visit

September 22, 2011

By

Evan Armstrong

Key Personnel:

Craig Cartmill, General Manager – Worldwide Aftermarket Operations

Paul Nyers, Sales Manager – Aftermarket Services

Richard Fulks, Director of Operations – Americas

Jason Kraus, Manager Business Development – Aftermarket Services

Meritor Aftermarket and Third-Party Logistics Operations Overview

To most Logisticians, Meritor is best known for its truck component manufacturing operations. Meritor manufactures truck axles, brake assemblies, suspensions, and other parts/components under its Meritor, Euclid, Mascot, Meritor WABCO, and Truck Technic brands. In addition, Meritor is a global supplier of drivetrain mobility and braking solutions for original equipment (OE) manufacturers of trucks, trailers and specialty vehicles, as well as the related aftermarkets in the transportation and industrial sectors. Its customer base includes motor carriers, OE dealers, independent distributors and other parts/components customers.

As part of its production/manufacturing customer agreements, Meritor agrees to provide truck parts to support its commitment to the aftermarket for a minimum of 15 model years for some vehicles. To support its manufacturing and post-sale aftermarket service parts operations, Meritor has developed a significant global supply chain management network and requisite capabilities. In 2010, 27% of Meritor’s revenues came from its Aftermarket & Trailer division.

To leverage its global supply chain network and expand its customer base, Meritor has recently launched a third-party logistics (3PL) service offering as part of its aftermarket services operation. Meritor’s key aftermarket/3PL services and capabilities include: nine global call centers handling over 300,000 calls per year, domestic and international transportation management, reverse logistics and remanufacturing, materials management, inventory management, value-added warehousing and distribution, custom packaging, kitting, production line sequencing, and manufacturing support.

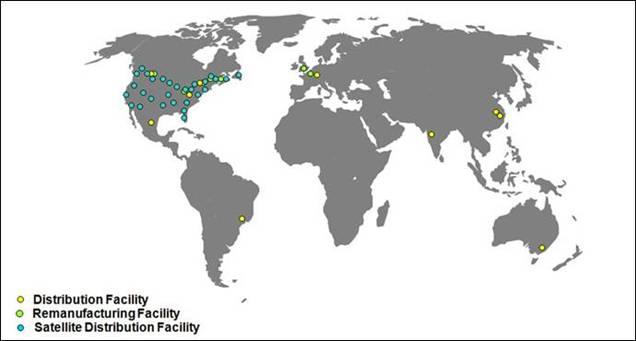

To fulfill its customers’ parts orders, Meritor has a global warehousing network with a combined footprint of 850,000 square feet. Meritor’s main North American aftermarket distribution operation is in Florence, Kentucky. It is the flagship operation in Meritor’s global warehousing and distribution network which includes 26 other regional warehousing operations throughout North America, several distribution centers across the Americas and Europe, and additional facilities in Asia Pacific. Outside of Florence, the average Meritor warehouse is approximately 60-70,000 square feet and is positioned to supply service parts to customers within a specific region. Its operations are highlighted in the figure below.

Meritor Aftermarket Services – Global Locations