Menlo Refines its China 3PL Model and Gains Business

Shanghai, China Site Visit

February 20, 2012

By

Evan Armstrong

Key Personnel:

Bob Bassett, Vice President of Sales and Marketing

Leong Choong Cheng, Senior Director of Business Development, North Asia

Jack Wu, Operations Manager

Steven Chen, Manager of Quality, Allison Transmission Asia Pacific Operations

Menlo China Overview

Menlo Worldwide Logistics generated gross revenue of $1.5 billion and net revenue of $572 million in 2010. It is on track to grow by over 6% in 2011 driving its gross revenue to approximately $1.6 billion. Menlo’s global staff of approximately 6,500 manages operations in 20 countries on five continents. Menlo’s expanding operational footprint has moved it into a select group of third-party logistics providers (3PLs) which we classify as tier-one major market 3PLs. Globally, HP is Menlo’s top customer, followed by Navistar, and the DTCI (Defense Transportation Coordination Initiative). It was also awarded a significant contract from GM to manage GM’s global spare parts and aftermarket accessories logistics operations in late 2011.

We recently had the opportunity to get updated on Menlo’s Chinese operations during a visit to Shanghai. Menlo has over 47 years of experience in China. In 1962, it established a Hong Kong office and in 1999 Menlo established a wholly-owned subsidiary, Shanghai-Menlo Worldwide Logistics (Shanghai) Company Ltd., in the Waigaoqiao (WGQ) Free Trade Zone (FTZ). In 2006, Menlo formed a wholly-owned foreign enterprise (WOFE) allowing it to provide domestic warehousing and transportation services. In 2007, Menlo greatly expanded its domestic mainland China supply chain management network through the acquisition of Shanghai based Chic Logistics. Chic was a significant domestic Chinese provider of non-asset based transportation management and value-added warehousing services. In 2009, Menlo rebranded the Menlo/Chic China operations as Menlo Worldwide Logistics, North Asia.

Today, Menlo North Asia is operated by a staff of 1,000. According to Menlo, it has refined its China 3PL model and marketing efforts to focus less on competing with local Chinese 3PLs for tactical logistics business and is concentrating on working strategically with domestic and multinational companies needing more complex logistics solutions. It has been using Menlo’s consulting services such as distribution network modeling as an entrée to developing new 3PL business. Key Menlo China accounts include: B&Q, Eaton, GM, Mary Kay, New Era, P&G, Powerwave, Shanxi Coking Group, and Unilever.

Menlo is a lead logistics provider (LLP) for Mary Kay in China managing the transportation, value-added warehousing, and sales counter operations for Mary Kay’s domestic manufacturing to direct sales channel. Menlo is also working with Eaton in North China performing value-added warehousing and distribution services for Eaton’s uninterrupted power supply products. It is also working with Shanxi Coking Group managing coal transportation in Shanxi Province in Western China. Powerwave is a global Menlo customer. In China, Menlo is managing Powerwave’s warehousing and domestic finished goods distribution.

For future growth, Menlo China is targeting customers in the following vertical industries and channels:

- Volume/Network Segments: FMCG, Chemical & Industrial

- High Value/Growth Segments: High Tech, Automotive Parts, Factory Logistics and 4PL/LLP & Supply Chain consultancy

- Direct Sales/Online Retail

- Bonded/Regional Hub

- Energy Logistics

Menlo recently gained several significant pieces of business in China including apparel and accessories distributor New Era. New Era has a contract with the United States based Major League Baseball and National Football Leagues to merchandise and distribute apparel and accessory items. New Era, in turn, contracted with Menlo to manage its domestic China value-added warehousing and distribution needs including returns processing. Menlo’s New Era operation is being managed centrally from its Hong Kong logistics hub.

Menlo China’s primarily non-asset based transportation management operation – with a moderate size fleet of over 60 self-owned trucks – is managing approximately 90,000 shipments per month using a regionalized hub and spoke network and utilizes over 1,200 trucks mainly from carrier partners on a daily basis for its transportation operation throughout China. The transport network has a centralized management and operations office in Shanghai with regional branches in Guangzhou, Beijing-Tianjin, Chengdu, Xian, and Wuhan. It is coordinating pickup and delivery services in over 110 major cities and is handling over 1 million metric tons annually.

Menlo’s transportation management services include: local distribution, long haul truckload and less than truckload shipment management, licensed Dangerous Goods transportation, and multimodal domestic freight forwarding using truck, air, rail, sea and barge transportation modes.

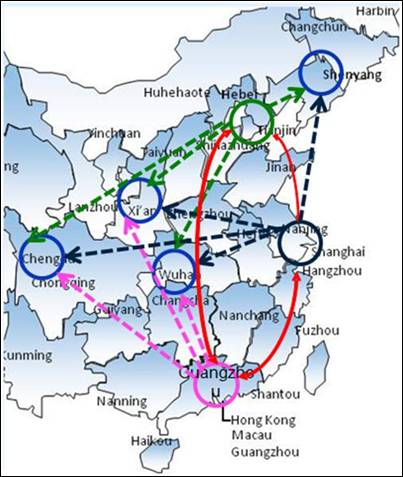

Main ground transport lanes include points to and from Shanghai, Guangzhou, and Beijing-Tianjin. Major one-way lanes include points from Shanghai, Guangzhou, Beijing-Tianjin to Xian, Chengdu, Wuhan, Shenyang, and from Xian to Urumqi. The map below highlights the major transportation network flows between Menlo’s hubs. Solid lines illustrate daily linehaul runs and the dashed lines show less than daily linehaul dispatches.

Menlo China Transportation Management Network Hubs and Major Shipment Flows

China’s central government recently changed its VAT (value-added tax) structure to encourage Chinese 3PLs to own assets. Menlo currently owns 60 trucks as part of its Chinese operation and is performing an analysis to determine if it should further expand its own fleet. All of Menlo’s trucks have onboard GPS tracking and tracing units installed for shipment visibility, which is a service differentiator in China.

Menlo’s China warehouse network boasts over 180,600 square meters of total space. In total, it has 19 distribution centers, three bonded warehousing operations, 45 field stocking locations, and fulfills over 20,000 orders per day. Its forward stocking locations mainly support Mary Kay and are also utilized by some online businesses. It is also running dedicated warehousing operations for multiple customers.

Menlo China Warehouse Management Network

Core warehousing services provided in China include: bonded and non-bonded FTZ warehousing and distribution, inventory management, customs filing and processing, cross-docking, vendor managed inventory programs, returns processing, and spare/service parts logistics management. In addition, Menlo is providing customers with numerous value-added services including: kitting, bar-coding, labeling, packaging/repacking, pick/pack, repair/refurbishment, and scrap/salvage management.

Menlo is perpetuating a “Lean” operating management culture globally and currently three facilities in China are Bronze certified. Menlo’s Lean warehousing certification is based upon measured operating performance versus goals and the success of process reengineering Kaizen (process improvement) events. The certification levels range from Bronze to Gold. Thomas Pan is leading the Lean training and management effort in China. In addition, he is also overseeing Menlo’s ongoing ISO 9002 quality certification process.

Menlo China Waigaoqiao (WGQ) Free Trade Zone (FTZ) Operations

As part of our visit, we toured three warehouses in the WGQ FTZ which serves as Menlo’s bonded/regional hub in Shanghai. The first warehouse was GM’s bonded operation, the next was for Allison Transmission, and the third was a multi-client warehousing operation. An overview of each is provided below.

GM Bonded Service Parts Logistics (SPL) Operation

The GM bonded service parts value-added warehousing and distribution operations began in 1999. Menlo processes customs registrations, returns, and performs domestic service parts distribution of imported parts from the 4,000 square meter facility. The operation is currently staffed by 16 people.

A staff of four work in the office processing customs filings and dealer orders. The remainder work in the warehouse. The operation is managed by Jack Wu.

General Motors Shanghai has a manufacturing plant in Pudong which utilizes SAP’s ERP (enterprise resource planning) system for order management. Orders “drop” from the SAP system driving picking within the Menlo GM warehouse. Over 8,000 SKUs (stock keeping units) of parts are maintained in on-hand inventory and outbound fulfillment and distribution totals 5,000 order lines per month destined to approximately 90 GM dealers and hundreds of service stations.

Menlo is also managing a non-bonded warehousing operation for GM in Jiading, Shanghai. Over time, more and more parts are being manufactured in China and distributed to dealers and other customers within China; therefore, the parts can be distributed from a non-bonded warehouse.

Allison Transmission Bonded SPL and Manufacturing Support Operation

Allison Transmission has been utilizing Menlo’s services for warehouse management and manufacturing support since 2008. The WGQ facility has a staff of 12 people managing the bonded warehouse light-truck transmission and spare parts logistics manufacturing support operation.

Parts are primarily imported from Allison Transmission’s manufacturing plant in Indianapolis. Export parts and transmissions are primarily shipped to Korea, Japan, Indonesia, and Singapore. A growing number, however, are also being distributed for use within China.

Six people work in the office processing inbound and outbound customs declaration registrations and performing order processing. For 2011, monthly import shipment customs registrations ranged from 22 to 48 and export customs registrations ranged from 67 to 106. Menlo was fulfilling approximately 300 to 1,100 order lines of parts and transmissions per month.

Six warehouse workers perform parts inventory management, pick/pack, distribution, and multiple value-added services. The value-added services being performed include: transmission component subassembly, transmission systems programming, parts calibration and testing, and parts kitting.

The operation has multiple key performance indicators (KPIs) including: pick & pack accuracy, pick & pack turnaround time, import and export customs registration lead time, and order turnaround time. At the time of our visit, Menlo was performing above its target thresholds in all of the KPI metrics.

WGQ Multi-Client Warehouse

In another WGQ facility nearby, Menlo is running a 3,500 square meter multi-client warehouse. Its customers include survey equipment manufacturer Trimble, coating/chemicals manufacturer PolyOne, Peter Thomas Roth skin care products, and a network server high-tech customer. The operation has a staff of 10 and recently received Menlo’s Bronze Lean certification.

Overall, the operation is fairly basic with multiple racks and bulk storage areas. In addition to case and pallet storage and distribution, some special project work is being performed. During our visit, a Menlo team was applying local market labels to tubes of Peter Thomas Roth skin firming lotions.

Menlo China Operations Summary

With expanding Asian, European, and North American operations, Menlo has advanced to being a true tier-one major market supply chain manager. While its China operations vary from advanced, such as Allison Transmission and Mary Kay, to fairly basic, as in the WGQ multi-client facility, each operation has a set of standardized work processes, customer performance metrics, and process improvement objectives. With its Lean management focus, Menlo has been able to attract significant new business from customers with average to complex supply chain management needs. With its refined China 3PL model and marketing efforts, Menlo has built a solid footing for future growth within China.

Sources: A&A Primary Research, https://www.xpo.com