For carrier procurement, M33 is managing ongoing carrier request for proposal (RFP) processes for over 90% of its customers with its four person carrier procurement and management group. Its approach is unique in that M33 performs the carrier bid analysis and reports the results. It then allows its customers to make the final carrier selections. This approach maintains M33 as an impartial party in carrier selection decisions. It is currently working with approximately 40 less than truckload (LTL), 250 truckload and intermodal providers, and a handful of freight forwarders in its network.

In terms of management, M33 does a lot of things right including: quarterly customer business reviews, biannual customer loyalty/satisfaction surveys, ongoing monitoring of internal service metrics, proactive process improvement, having a strong personnel hiring and mentoring focus, and providing its people with good compensation and work environment. Its customer loyalty is high and in nine years M33 has only lost five customers. According to Scott Riddle none left for service issues, “One went out of business, one was acquired by a larger company with its own internal operation, and the three others had business changes that no longer made us a match.”

The customer case studies below provide some insights into how M33 has worked with customers in improving supply chain management operations.

Customer Case Studies

Exopack LLC: Exopack develops, manufactures, and sources paper and plastic flexible packaging solutions and film coatings for consumer and industrial applications. These applications include: pet products, food and beverage, medical devices, lawn and garden, agriculture, chemicals and minerals, building materials, and electronics. It has grown significantly through mergers and acquisitions and increased its geographical footprint to 16 locations and multiple business units. Its executive management needed outside help in developing a plan to leverage Exopack’s transportation spend and take advantage of the significant potential synergies that existed between the operations. Additionally, its management had been charged by its parent company to reduce costs wherever possible without decreasing customer satisfaction.

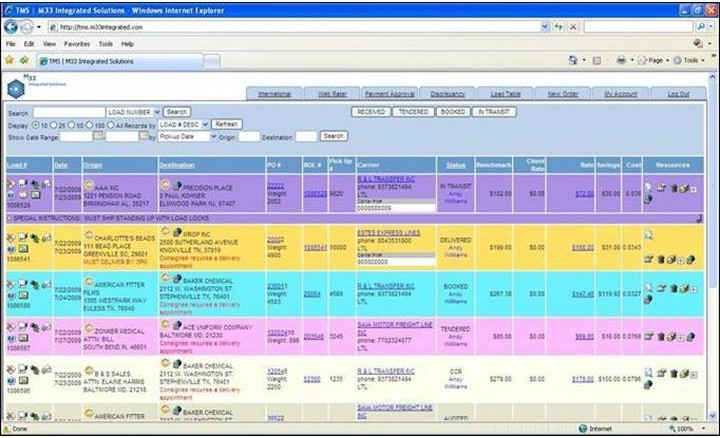

In partnering with M33, an operational plan to leverage its total transportation spend as a group was developed and implemented generating significant cost savings for Exopack. M33 also provided Exopack’s management with operational metrics from its daily transportation management operations. Carrier compliance tracking, shipment visibility, and benchmarked savings estimates were made available via the M33 TMS. Additionally, Exopack realized benefits from collaborative transportation capacity sharing within its own operations and across the M33 customer network. Through M33’s improved reporting, Exopack was also able to make informed decisions in realigning its supply chain operations and improving its costing processes.

Interfilm Holdings, Inc.: Interfilm Holdings is a distributor of a variety of plastic films and specialty papers designed for many industrial and packaging applications. For several years, Interfilm relied on its previous 3PL to provide it with competitive carrier rates using a static carrier routing guide approach. However, its management struggled with ongoing reasons by internal users across multiple plants to utilize other carriers versus the routing guide. Carriers specified, by the 3PL provided routing guide, were being used on only approximately 20% of the total shipments. In addition, service-related issues existed within the approved carrier base.

Interfilm partnered with M33 to implement an active load management solution operated through a web-based TMS. M33 monitored carrier reliability and user compliance and improved Interfilm’s satisfaction with its carrier base. As a result, customer satisfaction from on-time deliveries rose, and benchmarked savings rates significantly increased. Additionally, Interfilm has come to rely on M33’s reporting and consulting services to help it make better business decisions.

Treofan America LLC: Treofan America LLC is an international manufacturer of flexible packaging film. It was looking to significantly reduce transportation costs and had become wary of its prior 3PL’s uncompetitive transportation rates and managed warehouse services. Continued inflexibility on warehouse and transportation issues had strained both the warehouse and transportation budgets. Supply chain costs needed to be contained in order for Treofan to maintain market share and minimize customer price increases. In addition, the lack of visibility between Treofan and its 3PL and warehouses often caused excessive expedited transportation expense.

Once the contract was finalized, M33 moved quickly to relocate and replace expensive warehouse providers saving Treofan up to 50% in storage and handling fees per operation. M33’s TMS was deployed and provided visibility between the warehouses and Treofan’s management. This allowed them to greatly decrease expedited transportation expenses. In addition, having order visibility allowed for the consolidation of orders by geography and product availability. M33 was able to mode shift more orders and build lower cost volume LTL (less than truckload) and truckload shipments delivering Treofan significant transportation cost savings.

Summary

While it is small in comparison to other 3PLs with supply chain network management expertise, M33 has found a niche in focusing on mid-market customers with complex supply chains. As companies continue to find ways to reduce logistics costs in the current economy, outsourcing functions to 3PLs for improved transportation management is an increasing prevalent strategy. With its capabilities, M33 will continue to benefit from this trend.