Coyote Logistics Achieves Network Scale

Lake Forest, Illinois USA Site Visit

January 27, 2011

By

Evan Armstrong

Key Personnel:

Jeff Silver, President & CEO

Eddie Leshin, Chief Operation Officer

Chris Pickett, Vice President of Sales

Coyote Logistics Overview

Third-party logistics provider (3PL) Coyote Logistics was founded in 2006 by Jeff Silver and provides domestic transportation management services to customers in North America. Jeff was part of the very successful management team that founded and grew American Backhaulers, Inc. Backhaulers was sold to C.H. Robinson Worldwide at the end of 1999 for $100M in cash and $36M in stock.

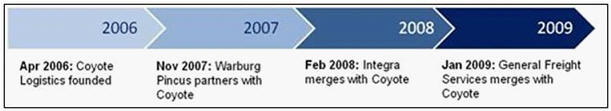

Coyote Logistics has grown rapidly from managing its first load in August 2006 to having estimated gross revenue of $380M and net revenue of $50M for 2010. Coyote experienced significant organic growth after its 2008 “platform” acquisition of Integra Logistics LLC. which had core competencies in intermodal rail transportation management services. In January 2009, Coyote acquired North American truck and intermodal transportation management 3PL General Freight Services to further round out its operations. Its growth timeline is shown in the figure below.

Coyote Logistics Growth Timeline Milestones

Coyote’s organic growth included hiring approximately 190 people in 2010. Most were college graduates which it trains to be account managers and carrier capacity managers. New account manager hires receive four to 12 weeks of training which includes phone skills/techniques, transportation equipment training, and map training. Each new hire has to memorize 750 map points/locations as part of their training. Today, Coyote has over 450 employees working out of its Chicago, IL headquarters and six branch offices.

According to Jeff Silver, Coyote’s mid-term goal is to grow its business to $1B in Gross Revenue by 2013-14, continue to realize a target EBITDA margin of 6%, and then move forward with an initial public stock offering to finance further growth.

Coyote managed over 24,400 shipments in October 2010 for over 1,000 customers. Its top 20 customers account for just over 50% of its revenues. According to Silver, Coyote has built significant network density and is looking to greatly expand its small customer base as it grows. Seventy percent of the shipments managed by Coyote are dry van truckloads, 12% are intermodal rail, 8% are LTL (less than truckload), and flatbed and refrigerated truckloads account for an additional 5% apiece.

The majority of Coyote’s loads are moved using transactional spot market pricing. Food & Beverage industry customers are 45% of Coyote’s business. Pulp & Paper accounts for 20%, 15% is with Consumer Products companies, Chemicals & Plastics is 5%, Metals & Minerals accounts for 5%, and other customer industry categories account for another 10%.

Coyote has approximately 20 large “Enterprise” accounts, including Heineken USA. Individual Enterprise groups manage one to three accounts and perform operations (such as setting delivery appointments) and customer service functions.

For carrier capacity, Coyote has relationships with approximately 15,000 active carriers. Of those, approximately 7,000 have significant volumes and 800-1,000 are core carriers. Approximately 175 carrier capacity operations staff are based at its Chicago headquarters and are grouped by geography using NCAA conference territories.

“Coyote Cool” is the name given to the group of approximately 50 people targeting/sourcing refrigerated carrier capacity. According to Silver, 85% of its carrier reefer capacity is with small carriers.

Coyote has approximately 100 people in Alpharetta, GA at its old General Freight headquarters. Almost half are in Driver Services (providing driver instructions, shipment track & trace, carrier compliance, and carrier proof of delivery gathering). Its carrier compliance department and additional administrative staff are also based in Alpharetta.

Bazooka Transportation Management System

To support its operations, Coyote has developed a proprietary TMS (transportation management system) dubbed “Bazooka”. It is a solid freight brokerage operating system and Coyote has incorporated CPLEX optimizers to support daily transportation planning routines to consolidate LTL shipments into multi-stop truckloads. Batches of orders are run through the optimizer each night for next day load planning.

Bazooka has separate tabbed screens for open loads, covered loads, dispatched loads, loaded loads, and delivered loads. Each individual load is color coded within each of the screens to identify its current status. The system allows carrier capacity staff to quickly sort carriers by transportation mode, lanes handled previously, quality scores, carrier ownership classifications, and other attributes.

It has master files for customers and carriers. Each customer is tied to a specific set of accessorial charges and a fuel surcharge schedule. Carriers have an overall quality score based upon past service performance and the system has carrier files for organized tracking of insurance and regulatory compliance requirements.

Bazooka has significant ad hoc and custom reporting capabilities and “root cause” analysis functionality.

Coyote currently has an IT staff of 20 people which includes 14 developers and two customer on-boarding specialists.

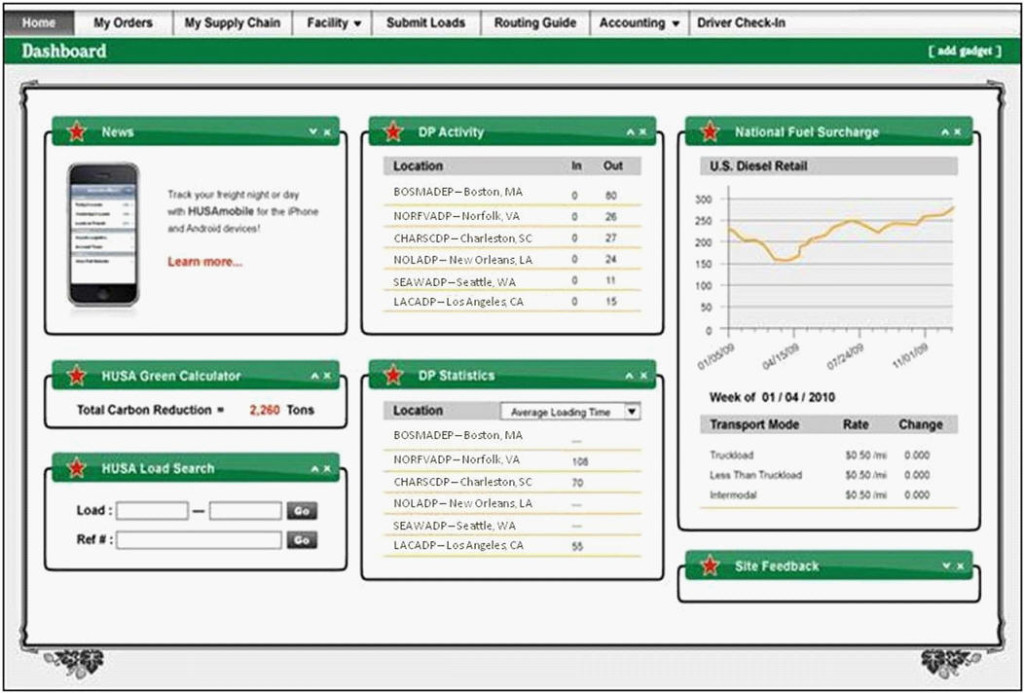

Coyote provides enterprise customer Heineken USA with customized screens to access the Bazooka TMS. A screenshot of the home screen is shown below.

Coyote Logistics Heineken USA Customized Bazooka TMS

Heineken USA Transportation Management Case Study

In 2010, Coyote was selected by Heineken USA to manage all of its US inland transportation for Heineken’s portfolio of Dutch beer brands – including Heineken Lager, Heineken Light, Amstel Light, and Buckler non-alcoholic brew. The selection was based on a strategic review of the company’s supply chain activities to help deliver against corporate growth goals.

Coyote manages the outbound transportation of the company’s Dutch beer brand portfolio from Heineken USA’s six Demand Point centers. This includes dry and refrigerated truckloads and some port drayage activities. In effect, Coyote Logistics handles every bottle, can, DraughtKeg, and keg of the Dutch beer portfolio that makes its way to any store shelf, bar tap or restaurant in the United States.

Heineken USA’s six Demand Point facilities support its national distributor network. Today, its current supply chain operations including its use of Coyote, have streamlined Heineken’s import activities and provide it with the flexibility to support future sales growth. Heineken USA has been able to reduce costs and provide an enhanced service model to its network of distributors. While importing product from breweries 3,000 miles away, Heineken USA has decreased order lead time from brewery to store shelf from 10 weeks in 1996 to seven days.

Through the 2010 acquisition of Fomento Económico Mexicano, S.A.B. de C.V.’s (“FEMSA”) beer operations (known as CCM) by Heineken USA’s parent company, Heineken NV, Heineken USA is also the US importer and marketer of the Dos Equis, Tecate, Tecate Light, Sol, Carta Blanca and Bohemia brands. As a result of the success of the Dutch program, Coyote has recently expanded its partnership with Heineken USA to include a significant portion of the US inland transportation for its portfolio of Mexican brands.

Coyote Logistics Operations Summary

Coyote Logistics has grown rapidly since its inception in 2006. It has a strong freight brokerage business model and Jeff Silver and team have a solid track record of building sizable operations. We anticipate that Coyote will continue building on its growth and strengthening its domestic transportation management brand in the years to come.

Sources: A&A Primary Research, http://www.coyote.com/