BNSF Logistics Stays on Track

Springdale, Arkansas USA

July 15, 2010

By

Evan Armstrong

Key Personnel:

Eric Wolfe – Vice President & General Manager

Andy Cordischi – Vice President, Technology & Engineering

Mark Richards – Vice President, Finance

Mike Lancaster – Vice President & General Manager, BNSF Logistics International

Yancey Bowen – Vice President, Domestic OTR Transportation

Frank Armstrong – Vice President, Business Development

Robert Sutton – Director, Domestic Specialty Services

Shannon Boyd – Director, Marketing and Business Development

BNSF Logistics Company Overview

Founded in 2002, BNSF Logistics (BNSFL) has grown rapidly and managed over $340 million in transportation in 2009. BNSFL provides both non-asset based domestic and international transportation management services and has taken significant steps to reposition itself in the third-party logistics market from a North American centric over-the-road transportation manager to a major market global supply chain manager with significant domestic North American multimodal capabilities.

While approximately half of its growth has been organic, BNSFL has used strategic acquisitions to build a network of 24 offices and to increase the breadth of its service offering. With six successful acquisitions under its belt, BNSFL continues to look at acquisitions as part of its strategy for future growth.

Its acquisition history is detailed below:

► February 1, 2008: Diversified Freight Logistics and Royal Cargo Line

• Non-asset based international freight forwarder, NVOCC and customs broker

• 45 employees and a network of over 1,700 agents

• Two warehouses with 38,000 square feet

• Gross revenues of $40 million in 2007

► January 2, 2007: Pro-Am Transportation Services

• Non-asset based domestic transportation management company

• 23 employees

• Gross revenues of $25 million in 2006

► June 7, 2004: Sumark Services

• Non-asset based domestic transportation management company

• 54 employees

• Gross revenues of $40 million in 2003

► May 3, 2004: Rite Choice Transport

• Small non-asset based domestic transportation management company

• Gross revenues estimated at $5 million for 2003

► September 15, 2003: MRS Companies

• Non-asset based domestic transportation management company

• 34 employees

• Gross revenues estimated at $16 million for 2002

► August 13, 2002: Burlington Northern Santa Fe Corporation (BNSF) announced the formation of BNSF Logistics, LLC

• BNSFL acquired certain assets of Clicklogistics, Inc.

• Clicklogistics was a non-asset based domestic transportation management company.

Much of BNSFL’s recent organic growth has come from its ability to effectively manage rail in addition to intermodal and truck transportation. Rail-related transportation accounts for approximately 26% of its total transportation under management, and BNSFL is one of a handful of U.S. based third-party logistics providers (3PLs) who can effectively manage rail transportation and rail-related services including site selection for transload operations, load and tie-down plan configuration, velocity improvement planning, demurrage reduction, private railcar fleet analysis and management, EDI waybilling, and empty car order and release.

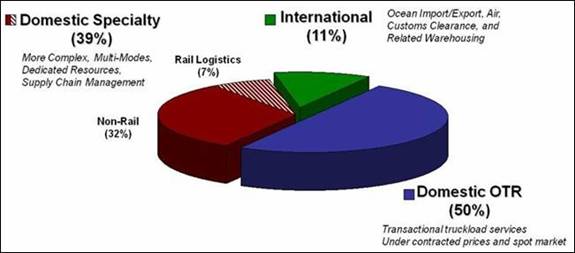

This multimodal competency coupled with value-added services and strong information technology provides BNSFL with a competitive advantage awarding it entree into large accounts with combined rail and truck transportation project needs. Value-added services include: cross-docking, transloading, expedited truck/rail service, specialized transportation, pool distribution, and supply chain network analysis and re-design. Amazon.com, Gamesa, The Home Depot, JCPenney, Morton Salt, Rio Tinto, and Wal-Mart are major BNSFL customers. Its gross revenue distribution by business segment is shown in the figure below.

Figure 1 – BNSF Logistics 2009 Gross Revenue by Business Segment

BNSFL delivers its technology solutions to meet the needs of each customer’s project scope. For network management 3PL customers, it utilizes JDA’s (formerly i2’s) transportation management systems (TMS) planning applications and MercuryGate’s TMS. BNSFL’s TMS functionality includes shipment optimization, consolidation and mode selection between rail, intermodal and truckload and for supply chain tendering, tracking and visibility. MercuryGate is also fully integrated with BNSFL’s proprietary freight brokerage operations/dispatch system. BNSFL International’s technology provides purchase order (P.O.) management and handles all transactions for global shipping.

BNSF Logistics International

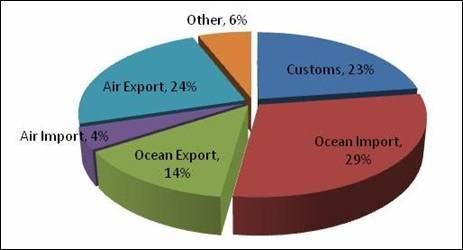

BNSFL International (BNSFLI) was created from the 2008 acquisitions of Diversified Freight Logistics and NVOCC Royal Cargo Line. It accounted for 11% of BNSFL’s 2009 revenues and managed over 12,000 ocean containers and 1.6 million kilos of airfreight. It has operations in Grapevine and Houston, Texas; Tulsa, Oklahoma, and opened a new office in New York City in 2009. BNSFLI is currently eyeing Chicago, Los Angeles, and Miami for its next office expansions.

BNSFLI’s core service offerings include:

► Global ocean transportation (NVOCC, Ocean Transportation Intermediary)

• Door to door, port to door and port to port

• Project freight

• Ro/Ro (roll-on/roll-off)

• FCL (full container load) and LCL (less than container load)

► Global air transportation (Indirect Air Carrier)

• Expedited, charter, door to door, airport to door and airport to airport

► Customs brokerage

• Customs clearance, reconciliation, duty drawback, temporary import bonds and customs

compliance

► Value-added services

• Insurance, AES (automated export system) filings, letters of credit and P.O. management

The figure below details BNSFL International’s business mix as a percent of net revenue/gross profit.

Figure 2 – BNSF Logistics International 2009 Business Mix by Net Revenue Percent

BNSFLI maintains memberships in the World Cargo Alliance, Advanced Professional Logistics Network, and the WCA Family of Logistics Networks, which enables it access to agents worldwide. The figure below indicates those areas in which BNSFLI has existing agent relationships in addition to its U.S. operations. BNSFLI is C-TPAT certified and validated.

Figure 3 – BNSF Logistics International Global Agent Network

Customer Case Studies

The customer case studies below detail the breadth of BNSFL’s 3PL operations and highlight some of its special projects work.

Amazon.com Small Package Distribution Operations

BNSFL started working with internet retailing giant Amazon.com in 2008. In the spring of 2009, BNSFL began supporting Amazon’s “Air Injection Program” and “AMTRAN” small package distribution programs through its package sortation operation in Hebron, KY.

Amazon.com customers are provided with two-day air service on orders from three of its Midwest fulfillment centers destined to the Los Angeles and San Francisco, CA markets through its Air Injection Program. Every night BNSFL manages outbound truckloads of packages from the fulfillment centers to its sortation operation in Hebron. At the sort, BNSFL personnel sort and load the packages into air containers destined to each market. Using airfreight linehaul, the containers are delivered to Amazon.com contracted couriers in each market for last-mile delivery. Average volumes for the operation thus far have exceeded 100,000 packages per month.

The AMTRAN program provides Amazon.com customers with expedited ground shipping service. BNSFL picks up packages at eight Amazon fulfillment center origins and delivers them into its Hebron sort. Approximately 3,500 to 8,000 packages are sorted each night to 20 destinations and loaded onto full truckload trailers. Each night, approximately 12 full truckloads of packages are dispatched for delivery to Amazon.com couriers for last-mile delivery.

Overall BNSFL has provided Amazon with significant savings and improved service levels from

Gamesa Specialized Intermodal Transportation Management Project

BNSFL began working with the U.S. operation of Spanish wind turbine power generator manufacturer Gamesa in 2009. Gamesa Wind USA imports wind generator towers through the port of Houston, TX and sources nacelles (windmill top components) from manufacturers in the Eastern U.S. BNSFL managed the rail and over-the-road transportation of components from the port and manufacturers to support the development of a Peoria, IL wind farm. And, it is currently providing similar services to Gamesa for the development of a major wind farm in Buffalo Ridge, SD.

BNSFL began working with the U.S. operation of Spanish wind turbine power generator manufacturer Gamesa in 2009. Gamesa Wind USA imports wind generator towers through the port of Houston, TX and sources nacelles (windmill top components) from manufacturers in the Eastern U.S. BNSFL managed the rail and over-the-road transportation of components from the port and manufacturers to support the development of a Peoria, IL wind farm. And, it is currently providing similar services to Gamesa for the development of a major wind farm in Buffalo Ridge, SD.

For the Peoria wind farm, BNSFL recently completed the delivery of 147 wind components (41 Nacelles and 106 Tower Sections) to a transloading and distribution operation in Illinois. The components included tower sections originating from the port in Houston and nacelle components originating in the Northeast. The tower sections were trucked to a transload site where they were loaded onto railcars. BNSFL oversaw the loading and securing of the towers. Two sets of 54 car unit trains of tower sections were loaded in a total of 10 days.

BNSFL leased nine acres of rail served property in Illinois which provided it with a distribution/transloading operation. A detailed plan of where each component would be stowed in the distribution operation was created by BNSFL’s in-house engineers. As the components arrived, they were transloaded off the railcar and either stowed in the yard or directly loaded onto outbound trucks for delivery to the Peoria wind farm installation field. An on-site BNSFL project manager oversaw the five week project to ensure the customer’s milestones were met. The project was a success and was completed within Gamesa’s specified timeframe.

Rio Tinto Group Rail Transportation Management

The Rio Tinto Group of mining companies generated revenues of $44 billion in 2009. BNSFL began working with its US Borax (now Rio Tinto Minerals) company operation in 2005. Initial operations concentrated on managing Borax’s outbound rail and truck transportation from its borate mine in Boron, CA and outbound bulk rail moves from Borax’s refining and shipping facility in Wilmington, CA to the Port of Long Beach. As part of the operation, inventory visibility and management services were also reengineered. By adding value through improved inventory management, increased railcar utilization and velocity, improved transit times, and reduced rail demurrage charges, BNSFL significantly reduced Borax’s logistics costs. These improvements led to BNSFL being awarded business from three other Rio Tinto companies in 2008—Rio Tinto Energy America, Rio Tinto Minerals, and Resolution Copper Mining. In addition, BNSFL was awarded Rio Tinto’s export customs work for international ocean containers and bulk vessel shipments. BNSFL and Rio Tinto recently signed another five-year logistics services agreement.

Rio Tinto Energy America runs four surface coal mines in the Western U.S.; three of which are in the Powder River Basin region of Montana and Wyoming. The Resolution Copper Mining operation is located in the historic Pioneer Mining District, three miles east of Superior, AZ. BNSFL was selected to manage the transportation of inbound MRO (maintenance, repair and operations) shipments to the mine sites for both companies and provide inbound shipment visibility and purchase order management support.

Rio Tinto Minerals mines Luzenac talc for papermaking from mines by Yellowstone Park in Montana. BNSFL manages the outbound transportation from the mines. Outbound talc shipments include hopper railcars, rail tanker cars of talc slurry, dry bulk, and truckloads of bagged talc.

In addition to supporting the Rio Tinto mining operations above, BNSFL also provides Rio Tinto Group’s U.S. operations with specialized transportation, LTL, truckload, and railcar capacity as needed.

Summary

BNSFL is increasingly focusing on delivering solutions for customers with complex transportation management needs that often require a multimodal approach. Customers are finding benefits from leveraging BNSFL’s rail and over-the-road transportation management capabilities. This business model has allowed Wolfe and his team to grow revenues and deliver solid margins.

Sources: A&A Primary Research, http://www.bnsflogistics.com/