Agility Continues its Global Expansion

Atlanta, Georgia USA

March 10, 2009

By

Evan Armstrong

Key Personnel:

Mokhtar Bazaraa, Senior Vice President

Gultekin Kuyzu, Senior Manager

Overview

In 1979 Agility began providing logistics services and with 2008 revenues of $7 billion and operations in over 100 countries, it has expanded rapidly to become a top-ten global supply chain manager. It has grown both organically and through acquisitions of U.S. based GeoLogistics and several smaller sized third-party logistics providers (3PLs). Agility focuses on offering customers supply chain solutions tailored to meet individual business needs through a global network of warehousing facilities and transportation management operations. As part of its growth strategy, Agility has adapted an “asset-right” business model, which means acquiring assets to meet specific customer and regional market logistics needs. Major Agility customers include: ABB, BP, Epson, General Electric, Halliburton, Nestle, Nike, Princess Cruise Lines, Shell Oil, Siemens, U.S. Department of Defense, and Wal-Mart.

Agility is a publicly traded company organized into three major business groups. Global Integrated Logistics (GIL) is the largest with revenues of $4.5 billion and more than 23,000 employees. Over $4 billion of its revenues are generated outside of the U.S. GIL has core competencies in freight forwarding, contract logistics/warehousing, project logistics, fairs & events, and supply chain management 3PL services. Agility’s annual freight forwarding volume tops 420,000 ocean trailer equivalent units (TEUs) and its airfreight volume is over 490,000 tons.

Defense & Government Services (DGS) generates $2.2 billion in revenues for Agility and has a workforce of over 10,000. It provides 3PL services tailored to governments, relief agencies and international institutions worldwide. These services include extensive warehousing and trucking operations in Kuwait to support U.S. Department of Defense distribution needs in the region.

The final business unit is Investments which draws on local insights from Agility’s global network to identify real estate and private equity opportunities in Asia, Africa and the Middle East. Investments has revenues of $200 million and employs more than 2,000 people.

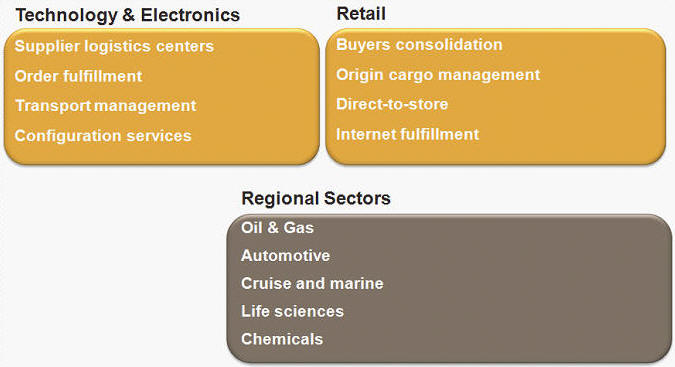

Agility focuses on developing 3PL business and solutions for three major internally defined sectors: Technology & Electronics, Retail and Regional Sectors. These are detailed in the figure below.

Figure 1, Agility Sectors for Focused Growth