AFS Logistics Strategically Adds Capabilities Becoming a Full-Fledged Transportation Management 3PL

Shreveport, Louisiana USA Site Visit

April 1, 2021

By: Evan Armstrong & Cheri Grabowski

Shreveport, Louisiana USA Site Visit

April 1, 2021

By: Evan Armstrong & Cheri Grabowski

Key Personnel:

Tom Nightingale, Chief Executive Officer

Dean Jones, Chief Channel Development Officer

Mingshu Bates, Chief Analytics Officer

Nathan Johnson, Chief Information Officer

Chet Richardson, President of LTL

Andy Dyer, President of Transportation Management

Scott Lord, President of Parcel

Roberta Tamburrino, President of Freight Audit & Payment

Anna Claire Stevens, Marketing Specialist

Founded by Brian Barker in 1982, Shreveport, Louisiana headquartered AFS Logistics (AFS) is a rapidly growing third-party logistics provider (3PL) with extensive transportation service offerings. Alongside its high-volume freight audit and payment (FAP) capabilities, AFS services include managed transportation, freight brokerage, international transportation management, parcel and less-than-truckload (LTL) cost management, supply chain optimization, and multi-tiered analytical solutions through its proprietary AFS analytics system.

To complement its organic growth, AFS has made 17 acquisitions over the last 20 years. Some acquisitions fill a niche, such as Insource Spend Management Group, while others like Logica have added vertical synergies. Most recently, AFS acquired Software Solutions Unlimited, Berman Blake and Associates, and William Carter & Associates. It has grown to seven major locations with over 300 teammates throughout the United States.

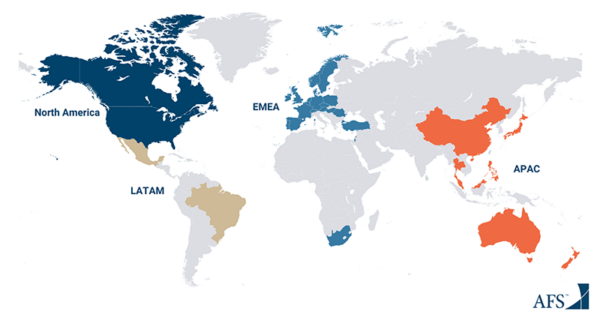

AFS Logistics’ customers range from Fortune 10 companies to small shippers. In total, AFS has over 1,700 customers in 35 countries. Its primary industries served include automotive, industrial, technological, manufacturing, healthcare, and consumer goods. Most recently, AFS has seen its strongest growth from e-commerce shippers.

AFS has four main service lines: Freight Audit & Payment, Less-than-Truckload (LTL), Parcel, and Domestic and International Transportation Management. Its proprietary systems provide transportation management functionality to support operations and analytical capabilities and reporting which support AFS’s consultative customer relationship style.

Still owned by its founder and Chairman, AFS began as a single employee freight audit company and has turned 39 years’ worth of expertise into a competitive differentiator. AFS audits and pays over 300 million freight bills totaling $10 billion in transportation spend annually. AFS’ focus on transportation spend transparency has driven a total cost savings of $200 million to customers annually, ultimately increasing customer loyalty. AFS has an average customer relationship of more than 11 years.

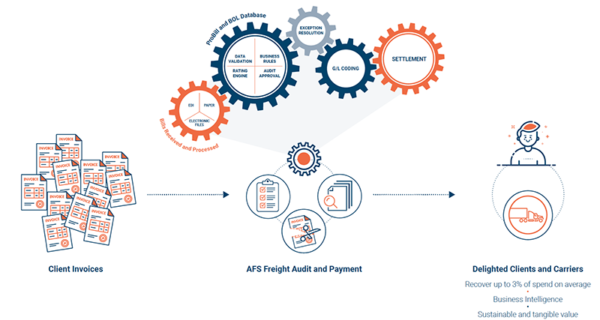

Freight bills are scanned or inputted using OCR technology. AFS’ proprietary rating engine audits relevant components (such as unit of measure, quantity, and price), as well as other variables for each distinct mode of transportation. For example, audits of LTL shipments include freight class, and truckload audits include specific lane or regional rate structures. If the freight bill fails to match, the exception goes to a team of auditors for review.

According to AFS, approximately 20-25% of carrier freight bills fail to match agreed pricing parameters during the AFS audit process. Its validation and customized general ledger coding help to ensure compliance. On average, AFS freight bill audits save customers between 2.5-3.6% of their transportation spend. AFS protects its customers from undue and unwarranted freight expenses, while making sure timely settlements are paid to carriers. AFS has a six-person Carrier Support team which acts as a communication bridge. The company also cross trains its 45-person Freight Audit & Payment team to further its bench strength and better assist both customers and carriers.

AFS manages shipper-carrier negotiation and rate optimization processes with its LTL carriers and oversees more than $1.2 billion in LTL spend. AFS examines, negotiates, and proactively monitors all linehaul charges, accessorial charges, claims, classes, fuel, and tariffs. AFS provides weekly and on-demand analytics designed around key performance indicators (KPIs), non-compliant shipping, and carrier rerates. A typical customer saves around 10% of its LTL freight spend by using AFS LTL programs. AFS prices its service to shippers using a unique gainshare.

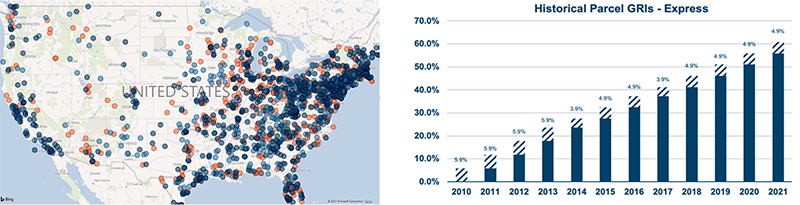

AFS assists with contract negotiation, spend reduction, back-office process improvement, and parcel contract/carrier compliance. It has developed proprietary systems to assist parcel cost management customers in understanding the true impact of parcel carrier’s pricing strategies. Leveraging its parcel pricing expertise, AFS utilizes its rating technology to provide a precise General Rate Increase impact analysis for customers.

Combing through complex data, verifying exceptions, and catching errors is time-consuming and removes focus from core business opportunities. Months of errors can add up quickly and become laborious to settle. AFS leverages its visibility into over $4 billion in parcel spend, along with its deep analytics to proactively monitor rates, uncover costs savings opportunities, and predict new business trends. AFS’ parcel audit has realized over $30 million in client savings over the last five years. And according to AFS, its combined parcel audit and cost management services typically save customers around 5-8% on annual parcel spend.

AFS provides managed transportation for all over-the-road modes. From carrier sourcing, procurement, and onboarding to load tender, track and trace, order processing, invoice auditing, and final bill payment, AFS can manage the process, end-to-end, for customers. AFS analyzes truckload and LTL pricing and lane data to effectively optimize transportation. Customers receive dynamic analytics through cost and service monitoring, trend analysis, and carrier/routing compliance. The average managed transportation customer saves 10-12% of its annual freight spend.

AFS has built a network of over 11,000 truckload carriers and 80 LTL carriers which it leverages in its brokerage operation to meet customers spot and contract transportation needs. In addition to standard domestic truckload and LTL transportation management, it oversees expedited shipments destined to Canada, Mexico, Alaska, and Hawaii.

AFS develops a variety of supply chain solutions for its customers. These vary from integrated supply chain management plans to more targeted logistics planning and forecasting, as well as development of core carrier programs and transportation routing guides. Solutions are driven by the proprietary AFS analytics and network optimization algorithms.

As a network design example, a customer may be evaluating the need for a second distribution center (DC). AFS analyzes the customer’s current shipment characteristics versus the new network plan for LTL and parcel shipments, and models different cost/service optimization scenarios to support decision making.

AFS Logistics extends beyond the United States with both its international parcel and freight forwarding services. AFS is a licensed non-vessel operating common carrier (NVOCC) and indirect air carrier (IAC) managing ocean and air transportation shipments globally across 35 countries.

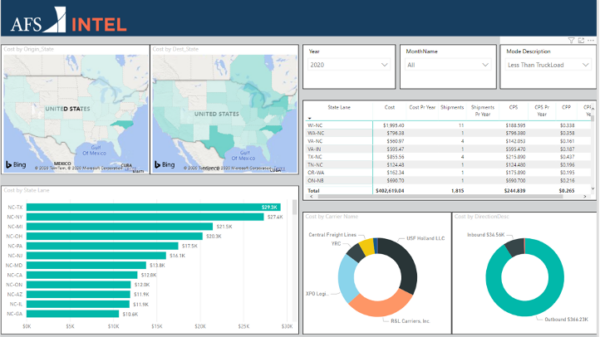

AFS views analytics as core to its value proposition and many customers are drawn to AFS because of the robustness of its analytics offerings. AFS’s interactive reporting tools, driven by a suite of commercial and proprietary BI tools, empowers customers and carriers to access underlying data for decision making. The “standard” AFS analytics reporting solutions include the following data and reporting:

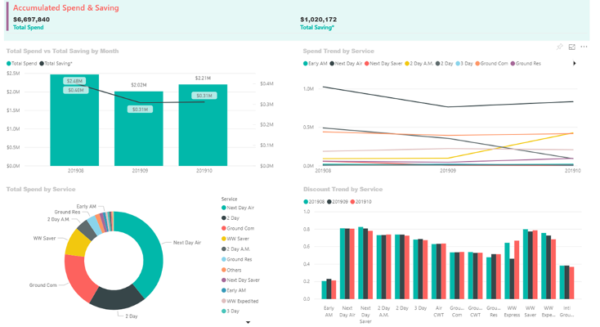

AFS also delivers “customized” dashboards, analysis results, and data visualization. Below is a customized tool created for a major parcel cost management customer showing savings from old versus newly negotiated parcel contracts.

Due to its access to such a large volume of data, AFS can provide market pricing benchmarking analyses driving well informed contract negotiations.

To manage its operations AFS has developed a suite of IT solutions which are described below.

Fashion Retailer Leverages AFS’ Parcel Spend Visibility to Lower Shipping Costs

An omnichannel specialty fashion retailer teamed up with AFS to post audit its parcel shipping charges. Using its systems and $4 billion/year in parcel spend visibility, AFS analyzed the shipper’s parcel data and identified a high volume of accessorial charges and shipping charge corrections. These charges accounted for 10% of the company’s overall shipping spend.

Due the nature of the retailer’s fulfillment, it was imperative that it reduce these charges through process standardization. AFS revamped the retailer’s packaging supplies and consolidated its shipping boxes into eight standard sizes—each with its own classification. Employees now enter the new box classification into the company’s parcel management system, and the box dimensions are automatically calculated to decrease the number of errors. After 45 days of implementing AFS’ recommendations, the retailer saved nearly $300,000.

AFS has also leveraged its analytics and proprietary TMS to help the customer reduce transportation costs and improve processes in LTL routing and shipment visibility. Recently, AFS also successfully negotiated with a national parcel carrier to become the retailer’s primary carrier reducing the company’s parcel spend by 14%.

AFS Strategically Reduces LTL and Parcel Costs for Growing Industrial Equipment Supplier

For more than three decades, an industrial equipment supplier has provided tools and apparel to professional and beginner hobbyists. Over the last few years, the company has grown 40% organically and through acquisitions.

Its rapid growth has led to a highly decentralized transportation management environment with little process optimization. Its Chief Financial Officer lacked the time to source multiple carriers, negotiate contracts, ensure pickups were being made, and evaluate key performance indicators on service and claims. Adding to the complexity—some of its freight must be packaged, transported, and delivered within a 48-hour window.

AFS was enlisted to review its $11 million annual transportation spend for LTL and parcel shipping. The supplier had already outsourced its parcel audit to another provider but found it could reduce $3.5 million in annual LTL transportation spend by working with AFS. AFS was able to leverage visibility into its $1.2 billion in LTL transportation spend to negotiate with a mix of regional and national carriers. The newly negotiated price will yield the company more than $160,000 in annual LTL transportation savings.

Once the customer realized it could gain the transparency needed by utilizing AFS’s proprietary TMS, analytics and audit processes, it decided to outsource parcel cost management to AFS as well. This led to a savings of over 10% on its $7.5 million annual parcel spend.

In addition to using AFS LTL cost management and parcel cost management tools, the supplier has expanded its AFS agreement to also include truckload, international, freight audit and payment, and parcel audit.

A dedicated AFS Account Manager works daily with each of the customer’s locations to ensure it is using the appropriate carriers, filing claims correctly, and to ensure carriers are meeting agreed service standards. This process improvement and overall reduction in transportation cost has positioned the industrial equipment supplier to better serve its customers, while enabling the CFO to remain focused on the company’s growth objectives.

AFS has been quietly growing from its roots as a freight audit and payment company to a full-fledged, transportation management 3PL. While actively managing domestic, air, and ocean transportation, AFS continues to create value through its freight audit and payment, cost management services, and AFS analytics. Its executive team, comprised with talent from some of the largest carriers and other 3PLs, has in-depth industry knowledge, coupled with rich IT capabilities, which uniquely positions AFS as a differentiated provider. As capacity further tightens, freight rates increase, and e-commerce flourishes, customers can benefit from the transportation cost savings and visibility achieved through a relationship with 3PLs such as AFS Logistics.

Sources: A&A Primary Research, https://www.afs.net