U.S. Gains Carry 3PLs – 2011 3PL Market Analysis and 2012 Predictions is Released

FOR IMMEDIATE RELEASE

U.S. Gains Carry 3PLs – 2011 3PL Market Analysis and 2012 Predictions is Released

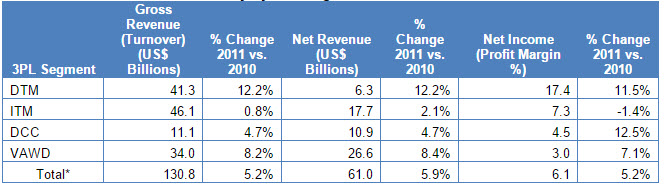

STOUGHTON, WI, May 22, 2012 – Domestic North American transportation and value-added warehousing were the bright spots for third-party logistics providers (3PLs) in 2011 while grim European and cooling Asian results produced flat international markets. Domestic transportation management net revenues increased 12.2% leading modest overall increases of 5.2% for gross revenue and 5.9% for net revenue.

Figure 1. U.S. 3PL Market 1996-2012E (US$ Billions)

The compound annual growth rate (CAGR) for the U.S. 3PL market since 1996 came in at 10.3%. For 2011, 3PL growth has been three times the growth in U.S. gross domestic product (GDP).

Domestic transportation management (DTM) led other segments in 2011. Gross and net revenues both increased 12.2%. Net income was 17.4% of net revenue.

Table 1. Revenues and Profitability by 3PL Segment – 2011

*Total 2011 gross revenue (turnover) for the 3PL market in the U.S. is estimated at $133.8 billion. $3 billion is included for the contract logistics software segment. Totals may be off due to rounding.

Value-added warehousing and distribution (VAWD) had a solid year with increases of 8.2-8.4%. Net income margins improved to 3% but VAWD continues to be a more mature segment which is less financially attractive than other segments.

Dedicated contract carriage (DCC) continued its resurgence in 2011. Trucking companies including dedicated contract carriers continue to keep equipment supply tight preventing the negative effects of oversupplying the market with assets.

Overall global logistics costs and 3PL revenue estimates by major region and country are also detailed in the report.

The complete report and other Armstrong & Associates research can be found at:https://www.3plogistics.com/shopsite/index.html.

About Armstrong & Associates, Inc.:

Armstrong & Associates, Inc. is a supply chain management market research and consulting firm specializing in competitive benchmarking, mergers and acquisitions, strategic planning, logistics outsourcing, centralized transportation management programs, and supply chain systems evaluation and selection. Armstrong & Associates publishes Who’s Who in Logistics and Supply Chain Management – The Americas and Who’s Who in Logistics and Supply Chain Management – International. Recent research papers include “The Business of Warehousing in North America – 2012 Market Size, Major 3PLs, Benchmarking Costs, Prices and Practices” and “Dedicated Contract Carriage – New Life in a Mature Market.”

For more information, please contact:

Richard Armstrong at +1-800-525-3915, or email Dick@3PLogistics.com.

Source:

Armstrong & Associates, Inc.

100 Business Park Circle, Suite 202

Stoughton, WI 53589 USA

Phone: +1-608-873-8929 Fax: +1-608-873-5509

Website: www.3PLogistics.com

Comments - No Responses to “U.S. Gains Carry 3PLs – 2011 3PL Market Analysis and 2012 Predictions is Released”

Sorry but comments are closed at this time.