Slow Dance – 2012 3PL Market Analysis and 2013 Predictions Report is Released

FOR IMMEDIATE RELEASE

Slow Dance – 2012 3PL Market Analysis and 2013 Predictions Report is Released

STOUGHTON, WI, May 21, 2013 – U.S. third-party logistics (3PL) market revenues increased modestly in 2012 in a slow dance mirrored by the U.S. gross domestic product (GDP). Results outside the U.S. reflected a recessionary Europe and warm but not hot results in Asia.

U.S. 3PL market gross revenues increased by 6% to $141.8 billion.

Figure 1. U.S. 3PL Market 1996-2013E (US$ Billions)

The 3PL market compound annual growth rate (CAGR) from 1996 to 2012 fell 0.3% to 10%. With U.S. governmental “sequestration” spending cuts kicking in, it is unlikely that the U.S. economy and 3PL market results will break the trend in 2013. A temporary budget surplus has taken pressure off of politicians to find solutions for huge, long-term U.S. deficit challenges. As John Maynard Keynes turns in his grave, the U.S. economy will grow slowly until the next major crisis.

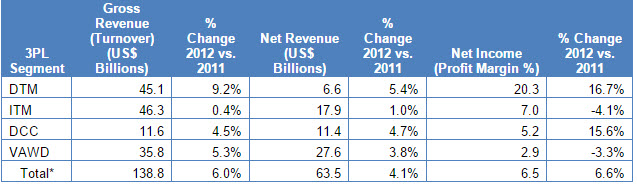

Domestic transportation management (DTM) led financial results for 3PL segments again in 2012. Gross revenues were up 9.2%. At the same time, the cost of purchasing transportation, increased competition, and slackened demand are pressuring DTM gross margins and net revenues. As a result, net revenues increased by only 5.4%. Overall gross margins were 14.6%. In 2011 they were 15.2%. 3PL earnings before interest and tax (EBITs) and net income margins remained strong. They were 33.2% and 20.3% of net revenue respectively.

Table 1. Revenues and Profitability by 3PL Segment – 2012

*Total 2012 gross revenue (turnover) for the 3PL market in the U.S. is estimated at $141.8 billion. $3 billion is included for the contract logistics software segment.

The largest negative in 3PL segment results was international transportation management (ITM). The results in ITM reflect the global economic malaise. Gross revenues grew 0.4% and net revenues were up 1%. Profit margins held as ITM 3PLs controlled costs. EBITs were 12% of net revenues. Net incomes were 7% of net revenues. For Expeditors International and Kuehne + Nagel (including its non-vessel operating common carrier Blue Anchor), EBITs exceed 30% of net revenue. Net incomes are also significantly higher. First quarter 2013 results for Expeditors were nearly identical to first quarter 2012 — a good indication of what 2013 results could look like.

The complete report and other A&A market research reports can be found at: https://www.3plogistics.com/shopsite/index.html.

About Armstrong & Associates, Inc.

Armstrong & Associates, Inc. is a supply chain management market research and consulting firm specializing in competitive benchmarking, mergers and acquisitions, strategic planning, logistics outsourcing, centralized transportation management programs, and supply chain systems evaluation and selection. Armstrong & Associates publishes Who’s Who in Logistics and Supply Chain Management – The Americas and Who’s Who in Logistics and Supply Chain Management – International. Recent research papers include “3PL Brand Recognition, RFP Activity and Expected Profit Margins for 3PLs – 2013,” “Mexico: Trucking, Railroads and Third-Party Logistics Market Report,” “The Business of Warehousing in North America – 2012 Market Size, Major 3PLs, Benchmarking Costs, Prices and Practices” and “Dedicated Contract Carriage – New Life in a Mature Market.”

For more information, please contact:

Richard Armstrong at +1-800-525-3915, or email Dick@3PLogistics.com.

Source:

Armstrong & Associates, Inc.

100 Business Park Circle, Suite 202

Stoughton, WI 53589 USA

Phone: +1-608-873-8929 Fax: +1-608-873-5509

Website: www.3PLogistics.com

Comments - No Responses to “Slow Dance – 2012 3PL Market Analysis and 2013 Predictions Report is Released”

Sorry but comments are closed at this time.