Meritor Targets the 3PL Market for Growth

Florence, Kentucky USA Site Visit

September 22, 2011

By

Evan Armstrong

Key Personnel:

Craig Cartmill, General Manager – Worldwide Aftermarket Operations

Paul Nyers, Sales Manager – Aftermarket Services

Richard Fulks, Director of Operations – Americas

Jason Kraus, Manager Business Development – Aftermarket Services

Meritor Aftermarket and Third-Party Logistics Operations Overview

To most Logisticians, Meritor is best known for its truck component manufacturing operations. Meritor manufactures truck axles, brake assemblies, suspensions, and other parts/components under its Meritor, Euclid, Mascot, Meritor WABCO, and Truck Technic brands. In addition, Meritor is a global supplier of drivetrain mobility and braking solutions for original equipment (OE) manufacturers of trucks, trailers and specialty vehicles, as well as the related aftermarkets in the transportation and industrial sectors. Its customer base includes motor carriers, OE dealers, independent distributors and other parts/components customers.

As part of its production/manufacturing customer agreements, Meritor agrees to provide truck parts to support its commitment to the aftermarket for a minimum of 15 model years for some vehicles. To support its manufacturing and post-sale aftermarket service parts operations, Meritor has developed a significant global supply chain management network and requisite capabilities. In 2010, 27% of Meritor’s revenues came from its Aftermarket & Trailer division.

To leverage its global supply chain network and expand its customer base, Meritor has recently launched a third-party logistics (3PL) service offering as part of its aftermarket services operation. Meritor’s key aftermarket/3PL services and capabilities include: nine global call centers handling over 300,000 calls per year, domestic and international transportation management, reverse logistics and remanufacturing, materials management, inventory management, value-added warehousing and distribution, custom packaging, kitting, production line sequencing, and manufacturing support.

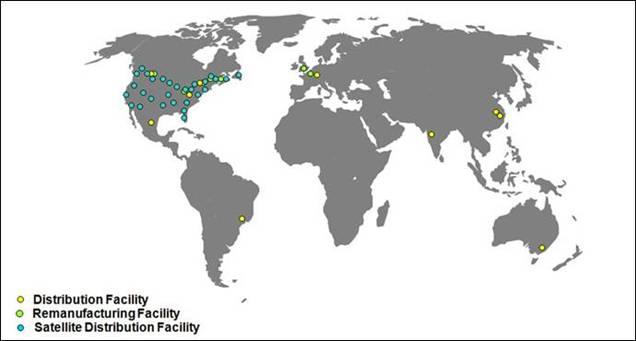

To fulfill its customers’ parts orders, Meritor has a global warehousing network with a combined footprint of 850,000 square feet. Meritor’s main North American aftermarket distribution operation is in Florence, Kentucky. It is the flagship operation in Meritor’s global warehousing and distribution network which includes 26 other regional warehousing operations throughout North America, several distribution centers across the Americas and Europe, and additional facilities in Asia Pacific. Outside of Florence, the average Meritor warehouse is approximately 60-70,000 square feet and is positioned to supply service parts to customers within a specific region. Its operations are highlighted in the figure below.

Meritor Aftermarket Services – Global Locations

Meritor’s recent network updates include the following newly constructed facilities: 32,000 square feet in Monterrey, Mexico; 59,000 square feet in Neuwied, Germany; 50,000 square feet in Osasco, Brazil; and 57,000 square feet in Australia. In addition, it has added additional space in Xuzhou, China and Pune, India. Meritor has also begun construction on a global consolidation center in Nanjing, China which will open in September 2012.

Within its global aftermarket operations, Meritor is processing over two million lines of annual parts orders in North America, over 120,000 lines in South America, over 191,000 lines in Europe, and over 100,000 lines in Australia. Customer parts orders are received via phone through its global call center network, via fax, electronic data interchange (EDI), its ecommerce portal, or as part of a vendor managed inventory (VMI) program. In all, Meritor’s global aftermarket operations are performing at a 94% on-time order fill rate and 99.8% shipment accuracy.

To support its 3PL market entry, Meritor has made a $28 million information technology investment. Key systems being deployed globally as part of a four-year systems rollout include: RedPrairie for warehouse management, Oracle for demand planning, inventory planning/optimization, and transportation management, Caelus for reverse logistics and remanufacturing, and IBM WebSphere for ecommerce. Also, Meritor is going to launch in December 2011, its voice directed order processing system which will increase productivity and efficiencies in the distribution of parts.

We recently had a chance to tour Meritor’s largest aftermarket parts warehousing and distribution operation based in Florence, Kentucky. It is detailed in the following section.

Florence, Kentucky Aftermarket Value-Added Warehousing and Distribution Operation

Meritor’s 400,000 square foot Florence, Kentucky value-added warehousing and distribution operation has a staff of 240 working in two shifts, five days per week. Its inventory contains over 90,000 SKUs (stock keeping units) of items and it receives approximately 30 truckloads of truck parts per day. The operation processes and ships over 7,000 order lines of parts daily; 6,500 of the lines processed are stock orders and 500 are for emergency/unit down orders. In addition, the operation is packing out over 50,000 cartons of parts and building over 30,000 kits per day.

Approximately 80% of Meritor’s vendors send advance ship notices (ASNs) via EDI (electronic data interchange) with details about inbound shipments. The ASNs are automatically received into Meritor’s RedPrairie WMS for inbound receiving. Upon receipt, Meritor’s staff inspect inbound quantities against purchase order quantities, note any damages or shortages, and label inbound parts with barcode license plates prior to being put away. The operation has a maximum 12-hour dock-to-stock performance requirement.

The operation’s 30,000 square foot packaging and kitting operation is centrally located in the warehouse and has 45 workstations. Kits are primarily built of parts and components from multiple vendors which are combined into individual poly-bags or packed into cartons. Approximately 900 SKUs of parts are packaged per day; 60% are unique items. Meritor performs a lot of short kitting and packaging runs. Once a run is finished, the packaging staff reconfigures and sets up the equipment for subsequent runs.

The warehouse has approximately 90,000 individual storage locations including 25,000 bin locations. Items are stored using an “ABC” inventory management methodology with faster moving items being held closer to pack stations and shipping.

Meritor’s WMS directs all standard warehouse tasks. Handheld and lift truck mounted RF (radio frequency) devices and voice picking hardware integrated with Meritor’s WMS drive warehouse picking. The operation uses a combination of floor picking in shelf and bin locations and lift truck picking for rack and bulk storage locations.

After significant process reengineering and warehouse planning, Meritor is currently able to perform approximately 60% of all picks by foot within a 19,500 square foot area right next to its eight packing and shipping lines.

The operation has eight packing/shipping lines and two automated stretch machine lines for stretch wrapping palletized parts. Two of the packing/shipping lines are dedicated to handle customer emergency/unit down parts orders.

Growing out of manufacturing, Meritor’s aftermarket operations clearly focus on Lean management principles and identifying ongoing process improvements. Through its Lean management program and resulting process improvements, Meritor has achieved the following productivity improvements at its Florence operation. From 2008 to 2010, cartons packed per hour are up 8%, lines received per hour have increased over 20%, on-time deliveries have increased over 40%, and lines shipped per hour are up over 50%. Each Meritor operation has a dedicated Lean person responsible for overseeing and supporting the program.

Meritor Operations Summary

Growing out of its manufacturing and aftermarket businesses, Meritor’s upstart 3PL operations have significant capabilities out of the gate. It has embraced a Lean management culture and runs efficient operations which strive for process improvements. Meritor’s $28 million IT investment also shows a considerable commitment level on Meritor’s part and with a growing global operating network, it continues to expand its presence in major international markets. With these attributes, we see significant potential for Meritor in attracting new Automotive and Industrial manufacturing vertical industry 3PL customers.