LEGACY SCS – Path to Fully Integrated 3PL Services

March 13, 2013

By

Kurt Baumann

Executive Management:

Ron Cain, CEO

Thomas Rouen, President/COO LEGACY SCS

Evolution of LEGACY Supply Chain Services

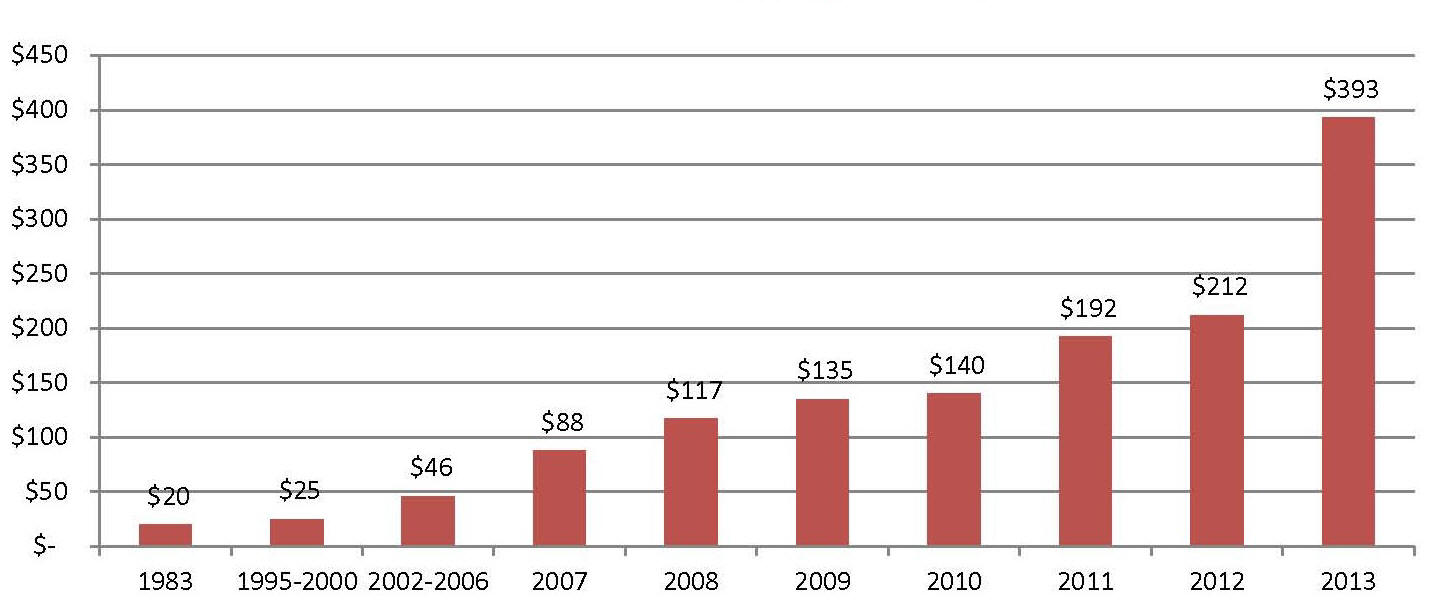

LEGACY Supply Chain Services, formerly TMSi Logistics, traces its roots back to 1983* when it started out as a temporary labor provider to warehousemen. LEGACY realized its acquired knowledge of labor management was better leveraged in direct operations management. The company formally started in third-party logistics (3PL) in 1995 with its first major contract customer, in the electrical parts industry, providing dedicated warehousing and truck delivery of electronic components at six locations. LEGACY proved that it was adept at turning around poorly performing operations, which led to expanded business into other verticals, including Industrial, Aircraft Engines, and Appliances. Since 1983, the company has grown by a compound annual growth rate of 18% and continues to evolve by expanding its service portfolio, entering new customer industries, and strategically acquiring 3PL companies to become a fully integrated supply chain and logistics services provider.

*Griffin Global Logistics, founded in 1975, was acquired by LEGACY in 2011.

|

|

|

|

|

Tri-Starr |

|

|

TMSi Logistics |

|

|

TMSi added |

|

|

TMSi added two |

|

|

TMSi added |

|

|

TMSi acquired |

|

|

TMSi Logistics |

|

|

LEGACY SCS |

In 2012, LEGACY SCS achieved gross revenue of $212 million with a workforce of 1,200 and flexible labor at peak times reaching 1,600 FTEs (full-time equivalents). Its geographic facilities footprint was regionally diversified within the U.S. with 20 facilities in 11 states and total warehouse square footage of 4 million. Ninety percent of LEGACY’s facilities were dedicated customer operations with a fleet of 65 trucks running delivery operations in metro Los Angeles. Two important acquisitions have enabled LEGACY SCS to rapidly expand its footprint and service capabilities, Griffin Global Logistics and Vitran Supply Chain Operations.

In 2011, the company acquired Griffin Global Logistics, which added 3PL international freight forwarding, customs brokerage, and domestic transportation brokerage, as well as multi-client warehousing. In 2012, 70% of LEGACY’s customer base was comprised of Consumer Products companies, followed by Technology, Industrial and Aftermarket Automotive. The addition of international freight forwarding and customs brokerage (ITM) allowed LEGACY to expand upstream in the global supply chain to arrange the inbound movement of goods from foreign ports, especially from Asia to the U.S., and provide a more integrated service to its customers. LEGACY is an NVOCC (non-vessel operating common carrier) with four licensed customs brokers on staff to handle documentation and shipment clearance. Certifications include IAC (Indirect Air Carrier), IATA (International Air Transport Association) and C-TPAT (Customs-Trade Partnership Against Terrorism. It uses CargoWise to arrange ocean shipments of TEUs (20′ container/trailer equivalent units) in excess of 3,000 annually and air freight of 400 metric tons.

LEGACY offers transportation brokerage (DTM), a service that originated in 2002. The primary freight mode is less-than-truckload at 60%, followed by truckload (dry van) at 27%, white-glove delivery, small package and intermodal. It recently implemented MercuryGate’s transportation management system (TMS), which is a leading system for domestic transportation management and freight brokerage. DTM is a relatively small, but rapidly growing service segment. LEGACY now has six transportation centers in North America.

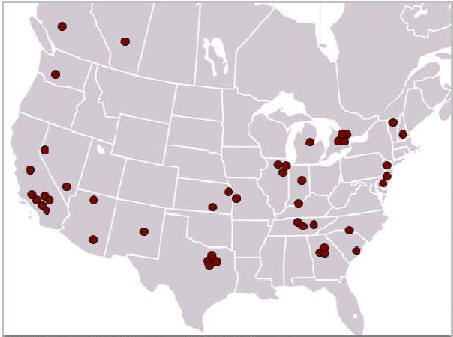

On March 4, 2013, LEGACY SCS completed the acquisition of Vitran Supply Chain Operations, a North American 3PL provider specializing in complex, high-velocity logistics, servicing leading North American retailers. Vitran SCO offers a range of services in Canada and the United States, including supply chain network design, over-the-road and intermodal freight brokerage, inventory management, flow-through distribution, and dedicated distribution facilities. With sales offices in Toronto and Los Angeles, Vitran SCO capitalizes on international traffic flows in North America. The acquisition expanded LEGACY’s distribution footprint from 25 to 42 operating facilities, including six facilities in Canada. With gross revenue of $393 million, LEGACY SCS now has over 2,700 employees contributing an average of $145,000 to gross revenue.

LEGACY SCS’ North American Footprint

Total warehousing space increased from 4 million to 6 million with an average facility size of 170,000 square feet. LEGACY SCS uses Manhattan SCALE warehouse management system (WMS). The acquisition of Griffin introduced multi-client operations, such as the Reno, NV facility. The further expansion of multi-client operations is a key objective for LEGACY SCS, as it allows for greater utilization of management and facilities resources, and overall cost savings for customers. With the addition of Vitran SCO, LEGACY SCS’ multi-client operations increased from 10% to 25%. More importantly, it expands LEGACY’s supply chain presence in the big-box retail market.

Expanded Full Service 3PL Solutions

In terms of 3PL segment focus, LEGACY SCS’ primary segment remains Value-Added Warehousing and Distribution (VAWD), which accounts for 87% of gross revenue, followed by Dedicated Contract Carriage (DCC) at 5%. International Transportation Management (ITM) accounts for 4% and Domestic Transportation Management (DTM) is 4% of revenue. The addition of both ITM and DTM provided LEGACY with an end-to-end capability that is particularly attractive to Consumer Products and Aftermarket Automotive companies, like Namsung Corporation and Remington Industries, which sell through major North American retailers, department stores, and automotive parts supply stores. LEGACY considers both 3PL segments as comprising key services for expanding existing customer relationships and growing its customer base in key verticals.

LEGACY SCS’ Service Offering

|

|

|

|

|

Dedicated |

|

|

|

Kitting, |

U.S. |

|

|

Inventory |

Domestic |

Facility |

|

Returns, |

|

LEAN |

|

Factory |

Specialized |

Logistics |

Vertical Customer Industry Diversification

LEGACY SCS continues to diversify its customer base. Consumer Products remains the dominant vertical, accounting for 43% of gross revenue, followed by Retail at 22%. The growth in its Technology customer base raised this segment to 16% of revenue. The remaining 19% of revenue is comprised of customers in various verticals, such as Government, Life Sciences and Food & Beverage.

LEGACY SCS’ Customer Industries Served

|

|

|

|

Consumer |

|

|

Retail & |

|

|

Food & |

Life |

|

|

|

Continuously Adding Value with Lean Enterprise

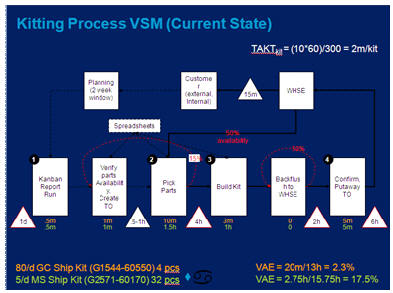

LEGACY SCS adopted Lean Thinking as its method for continuous improvement in 2006. Since then, it has achieved over $1 million in annualized cost savings for customers and over $200,000 in annualized savings for LEGACY SCS by improving space utilization, reducing cycle times, and error-proofing processes. It currently has 16 Lean certified associates.

Examples of success achieved through Lean include a Life Sciences company that sells bio-analytical instrumentation and installation services to Medical and Forensics Institutions. It was not meeting demand for Field Installation Kits, which results in delays in revenue recognition and lost sales.

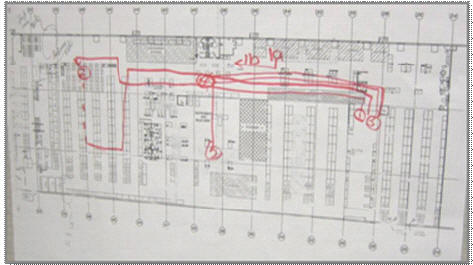

Over the course of a 3-day Lean Action Workout, LEGACY discovered a cycle time of 13 hours from dispatch to build, six miles of non-value-added travel per day in kitting, less than 50% fill rate on customer orders, and primary kits were always on the hot list in “red status” (Critical to Build). By applying Lean techniques, the team achieved the following results:

– 25% Reduction in Kitting Labor

– 55% Increase in Kits Built by Team

– 100% Fill Rate on Service Kits

– Reduced Safety Stock Levels

LEGACY leverages a proprietary leadership development model based on its corporate core values to develop a sustainable leadership culture throughout the organization. The culture drives employee engagement, leadership development, and reduction of waste; resulting in increased performance and decreased costs.

Conduit for Retail Suppliers

LEGACY SCS has established a complete portfolio of 3PL services in Retail logistics, serving both the major retailers and their suppliers, like Namsung Corporation. Namsung is a Korean company that manufactures consumer electronics for sale to major discount retailers. It needed a 3PL provider with a more central location in the Western United States that could provide better on-time shipment than the incumbent 3PL provider with fewer errors and inventory variances. LEGACY SCS won the business to manage distribution of Namsung’s Dual Electronics brand products from its multi-client facility in Reno, NV.

LEGACY was able to quickly relocate inventory and start-up operations with no interruption of service, and began shipping 16,000 units per week with a line fill rate of 100% on product SKUs (stock keeping units) that have internal inventory turns as high as 76 times annually. The Dual product consistently exceeds the customer’s in-stock requirement of 98%+. Inventory accuracy has averaged 99.9% for the past five years. LEGACY’s continuous improvement program identified and resolved labeling and packaging issues that were causing mis-shipments from inbound consolidation centers, as well as receiving errors at customer DCs.

In addition to distribution services, LEGACY SCS now provides a broader range of services to Namsung, including international freight forwarding and customs clearance. Handling international transportation gives LEGACY SCS better visibility and control to manage inbound containers, which has increased order processing efficiency and improved matching of inbound inventory with outbound order requirements. More importantly, it has reduced Namsung’s overall landed cost per unit by 12%.

Future Growth Trajectory

LEGACY SCS has worked hard, especially over the past decade, to broaden its 3PL services portfolio with a goal of providing integrated supply chain solutions for global customers, as well as to diversify its customer base. It is well-positioned to expand existing customer relationships with both ITM and DTM services. LEGACY’s ability to facilitate global inbound shipments and North American distribution should be particularly attractive to customers, like Namsung, that supply large retailers. Its expanded footprint in Canada should be attractive to U.S.-based and foreign Consumer Products and Food & Beverage companies that are seeking to increase trade in the thriving Canadian economy. LEGACY’s increasing emphasis on multi-client operations will make these end-to-end supply chain solutions more affordable and available to smaller suppliers that need to establish North American distribution operations with a 3PL provider that can scale its operations to accommodate growth.

Sources: A&A Primary Research, http://www.legacyscs.com/